2024 has been a pivotal year for Filecoin, with significant progress in the Filecoin Virtual Machine (FVM), Storage, Retrievals and Compute. In this blogpost, we’ll recap the key milestones of 2024 and take a look at the major growth drivers shaping Filecoin’s path into 2025.

2024 Retrospective

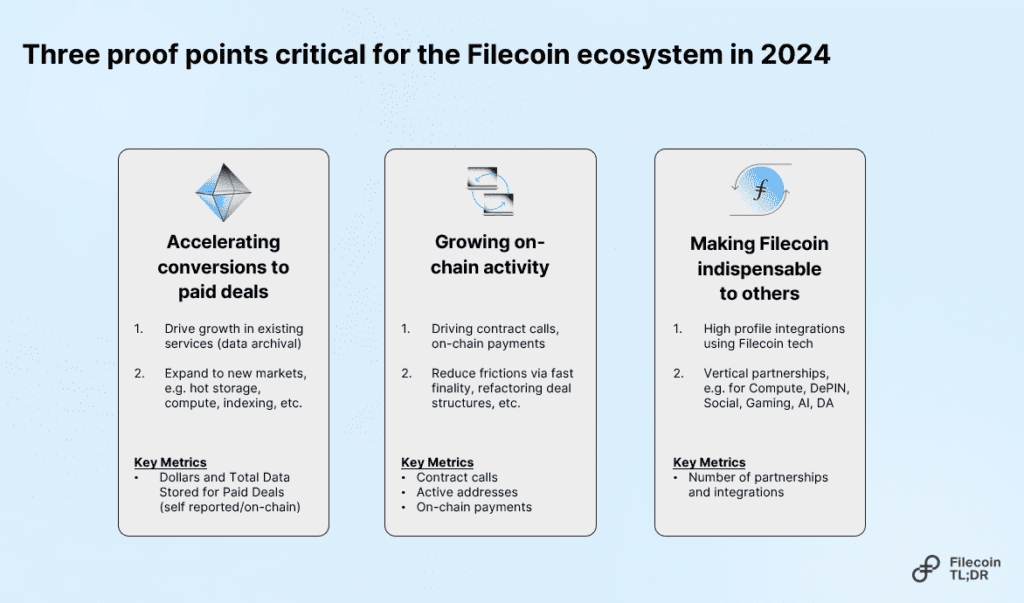

In our earlier blogpost ‘Charting Success for Filecoin 2024’, we mapped out three key priorities for the ecosystem in 2024:

- Accelerating Paid Deals: Boosting paid services (storage, retrieval, compute) on Filecoin to generate cashflow for service providers. This helps to support more sustainable hardware funding beyond token incentives.

- Growing On-Chain Activity: Increasing activity through programmable services, DeFi, and new use cases.

- Becoming Indispensable: Establishing Filecoin as an integral component of other projects and businesses.

These priorities are not mutually exclusive – they layer onto each other and are all signs that the Filecoin ecosystem is growing increasingly valuable.

So how did we fare across these priorities in 2024?

1. Accelerating Paid Deals

Paid Deals is an ecosystem-level metric that reflects the volume of paid services within the Filecoin network. FilecoinTLDR is currently tracking this metric here.

In 2024, Filecoin made significant strides in accelerating paid deals by reducing friction for businesses entering the ecosystem, with key advancements like the development of Proof of Data Possession (PDP) and the emergence of Layer 2 solutions.

- Enabling Efficient Hot Storage with PDP

- Projected for Q1 2025, Proof of Data Possession (PDP) introduces a new proof primitive to the Filecoin network, marking the first major proof development since Proof of Replication (PoRep) and Proof of Spacetime (PoSt). Unlike PoRep, which excels at cold storage through sealed sectors, PDP is designed for “hot data”, which is data that needs fast and frequent retrieval.

- This new proof type enables cost-effective “cache” storage on Filecoin without sealing and unsealing, enabling rapid data onboarding and retrieval. PDP opens the door for a new class of storage providers focused on hot storage and fast retrievals, benefiting onramps like Basin, Akave, and Storacha.

- Scaling Filecoin with L2s

- In 2024, we saw a rise in Layer 2 solutions built on top of Filecoin (We also covered this in our earlier blogpost “State of L2s on Filecoin”). L2s like Basin, Akave and Storacha enable both horizontal and vertical scaling with secure, customizable subnets. These L2s enhance Filecoin by unlocking new use cases: including managing data-intensive workloads, supporting AI and unstructured data, powering gaming and privacy-focused applications — all of which create more opportunities for paid deals.

2. Growing On-Chain Activity

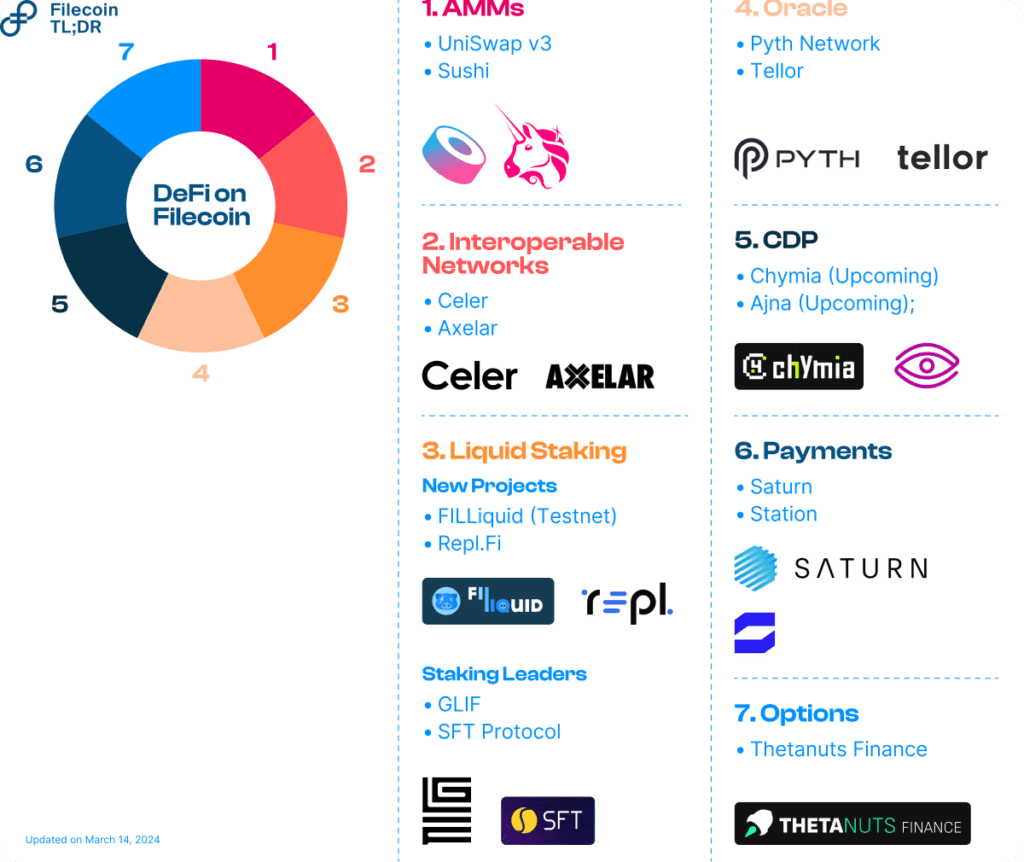

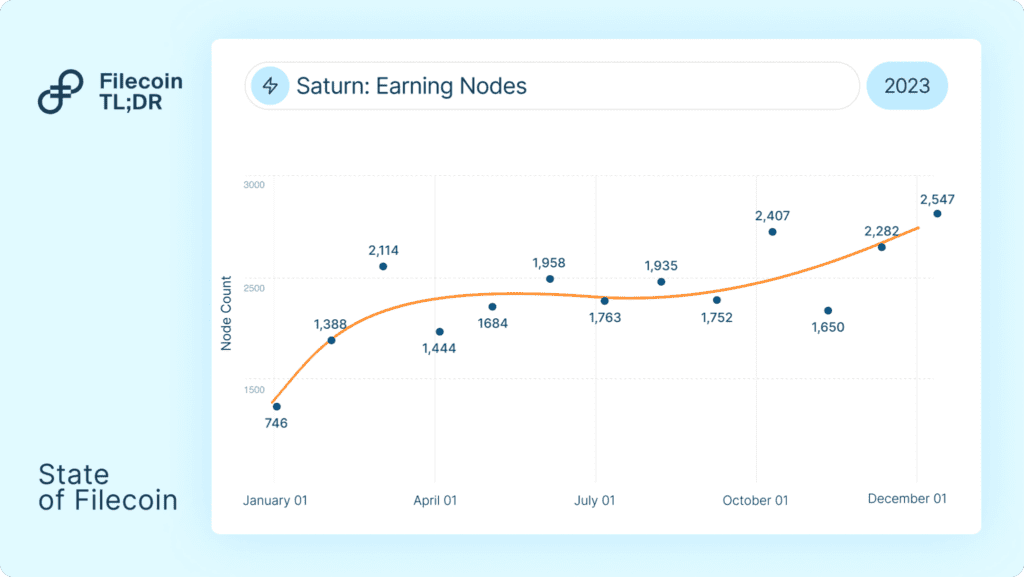

Filecoin has made notable progress in accelerating on-chain activity through the FVM, which spurred growth in its DeFi economy. The proposed Filecoin Web Services (FWS) and launch of FIL-collateralized stablecoins are set to further boost this momentum.

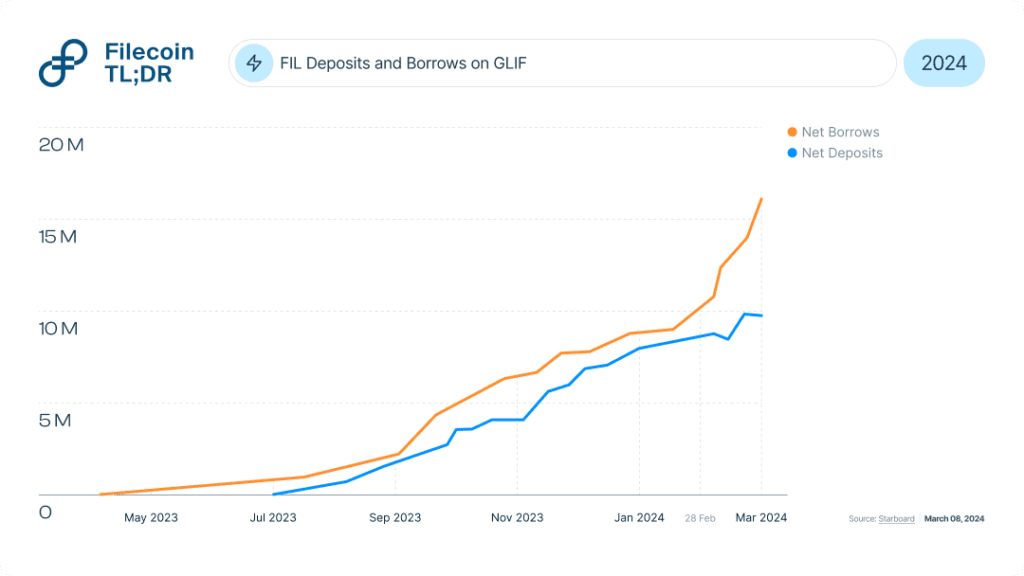

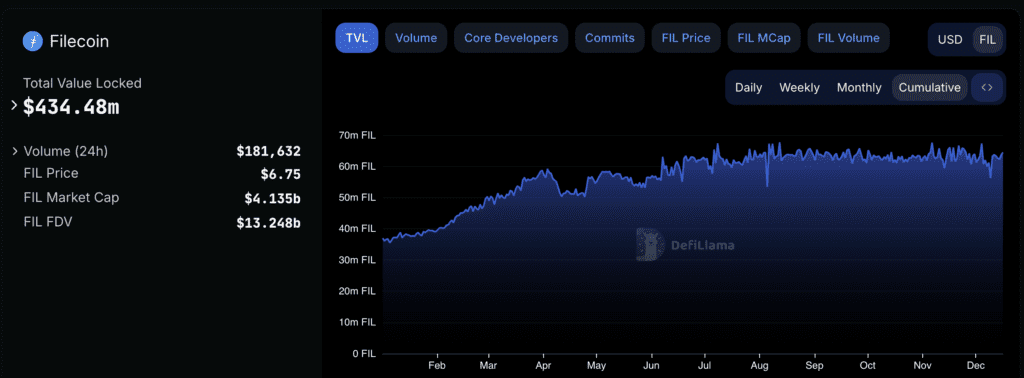

- DeFi Milestones

- As of December 16 2024, more than 4,700 unique contracts have been deployed on FVM, enabling over 3 million transactions. DeFi activity on FVM saw average net deposits exceeding 30M FIL ($200M), driven by staking, liquid staking, and DEXs, with GLIF leading at 62%, followed by FilFi (10%) and SFT Protocol (9%). Net borrows averaged 26M FIL ($173M), highlighting strong growth in Filecoin’s DeFi ecosystem.

- FIL-Collateralized Stablecoin for the Filecoin Ecosystem

- USDFC is a FIL-backed stablecoin launched by Secured Finance in Q4 2024 to address key challenges in the Filecoin ecosystem. It introduces stability to a network previously lacking stablecoin options, reducing volatility and enhancing value storage, much like DAI did for Ethereum.

- By allowing FIL holders and SPs to collateralize their assets for USD, USDFC helps cover operational costs without selling FIL, preserving asset value and network support. It also boosts liquidity in lending markets by providing FIL-backed stablecoin liquidity, driving more efficient capital flows within the Filecoin ecosystem.

3. Becoming Indispensable

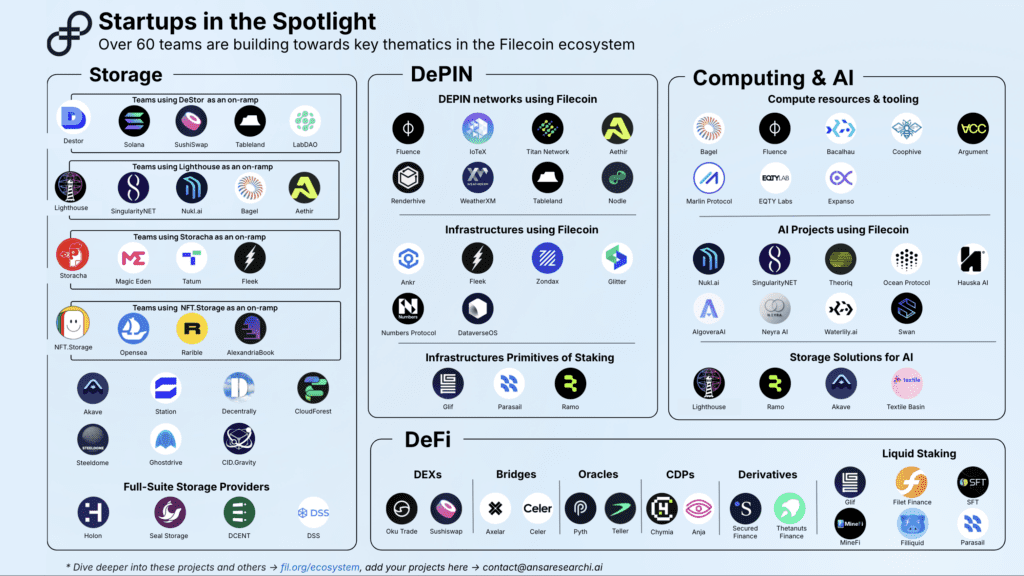

DePIN gained prominence, with Filecoin strengthening its position through key partnerships with AI and compute projects. Meanwhile, on-chain archival received significant recognition through major on-ramp partnerships.

“…thanks to Filecoin for building an awesome decentralized archive layer. “ – Anatoly (Solana Co-Founder)

- Notable On-Ramps of 2024

- At Solana Breakpoint this year, Filecoin founder Juan Benet highlighted how Filecoin’s zero-knowledge (ZK) storage is securing the entire Solana ledger.

- Similarly, Cardano apps now have the opportunity to boost data redundancy and decentralization through the Blockfrost integration with Filecoin.

- SingularityNET’s integration with Filecoin (via Lighthouse) emphasizes the growing need for scalable and cost-effective storage in the AI-driven era, where managing vast amounts of data efficiently is critical.

- These meaningful partnerships help signal Filecoin as a key player in both the Chain Archival and AI narratives.

- Compute & AI Partnerships

- This year, Filecoin has positioned itself as a key player in the growing field of Decentralized AI. The onset of projects within the ecosystem like Ramo (network participation), Bagel (AI & cryptography research), Swan Chain (AI training and development), and Lilypad (distributed compute for AI) highlight Filecoin’s expanding role in powering AI innovation.

2024 Filecoin Challenges

Despite the immense progress, we noted some challenges that the community faced. Though bearing in mind that Web3 products are still very early, and the problem statement of forming a credible alternative to the centralized cloud is a huge one.

Product Market Fit:

- Roadblocks like limited retrievability and high costs (driven by data replication), challenge the efficiency of the Filecoin network.

- There is a need to make payments easier by allowing transactions directly on the Filecoin network, using methods like stablecoins or flexible payment options.

- Improving visibility into the onboarding process and using customer data can help refine strategies and boost performance in key areas.

Building a Sustainable Economic Model + Stronger Economic Loops:

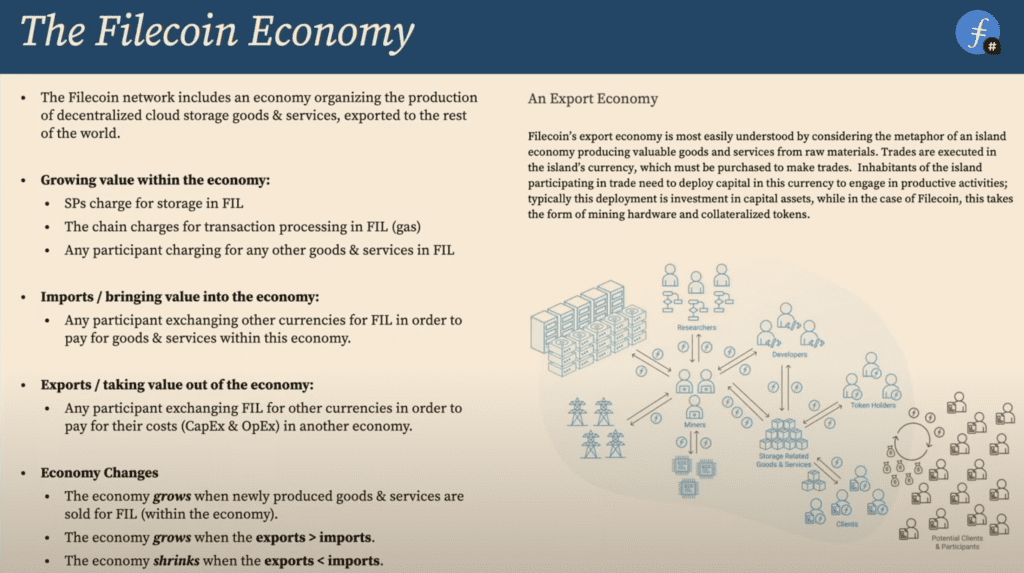

Viewing Filecoin as an island economy highlights its focus on accruing value by exporting goods and services while also keeping as much value as possible within the network by minimizing outflows.

- A key challenge lies in reducing external outflows while finding ways to boost exports and capture more demand within the ecosystem.

- Ensuring that transactions remain on-chain is equally crucial to strengthening this economic model and creating stronger economic loops.

Filecoin’s 2025 Outlook

Looking ahead to 2025, Filecoin’s evolution continues. Here are three key themes that could drive transformative growth for the network while addressing the 2024 challenges outlined above.

“Filecoin is at an inflection point.” – Blockworks Research

1. Accelerating Filecoin by 450x with Fast Finality (F3)

Fast Finality (F3), is one of the most impactful upgrades to Filecoin’s consensus layer since the launch of its mainnet. By drastically reducing transaction finality times, F3 overcomes a key limitation of the network’s original consensus mechanism. This enhancement is scheduled to go live on the mainnet in Q1 2025.

Old vs. New Finality:

- Before F3, Filecoin’s consensus mechanism ensured secure block validation but required 7.5 hours (900 epochs) to finalize transactions, which was too slow for applications like smart contracts or cross-chain bridges.

- With F3, transactions can now optimistically finalize in minutes—a 450X improvement.

What this means for Filecoin:

- Enhanced Speed & UX: Transactions finalize within minutes, enabling low-latency applications and eliminating the long waits previously experienced.

- Expanded Use Cases & Accessibility: L2 subnets like Interplanetary Consensus (IPC), Efficient smart contracts and decentralized applications, Blockchain bridges for interoperability with other chains.

Ultimately, this allows Filecoin to improve its usability across a wider variety of applications.

2. Moving Beyond Storage with FWS

Filecoin Web Services (FWS), emerged this year as a pivotal concept. It represents a strategic shift for Filecoin, expanding its scope from primarily a decentralized storage network to a broader marketplace for blockchain-based cloud services. This diversification can attract a wider range of users and use cases, potentially creating more positive economic loops within the network. Here are some pointers on why FWS should be on your radar:

- Strengthening Filecoin’s Competitive Edge: FWS will introduce features like Programmatic SLAs (which automate and enforce service agreements through smart contracts, ensuring clear performance expectations and penalties) and Verifiable Proofs (which provide cryptographic evidence of service delivery, allowing clients to independently verify service execution).

- Expands Filecoin’s Capabilities: Goes beyond Proof of Replication (PoRep) by adding Proof of Data Possession (PDP), enabling robust hot storage use cases. PDP will help improve data retrievability, a crucial factor in achieving product-market fit that has been widely discussed within the Filecoin community this year.

- Positions Filecoin as a leading platform in the decentralized web: FWS will facilitate the integration of multiple networks and protocols, creating a cohesive marketplace for storage, compute, bandwidth, and other services. This could make Filecoin a key player in the growth of the decentralized web.

FWS is currently a concept in development, with a new storage service featuring PDP (v0) underway. Following this milestone, the development of the FWS marketplace will begin with its expected launch in Q1 2025.

3. Unlocking new value streams in Filecoin

As a Layer 1 blockchain, Filecoin primarily generates revenue through gas fee burns (which happen when chain resources are used or when faults arise). However, relying on gas fee burns as a main source of revenue is not scalable and more importantly increases operational expense costs as well as service costs.

A sustainable approach involves value returning to the Filecoin economy through the use of services in the FWS marketplace, fostering a more scalable and balanced revenue model. A proposed value accrual mechanisms includes:

- FWS Fees: Commission (%) charged based on the transaction volume in the marketplace.

- Service Fees: Applied when a user accesses a service or a vendor provides one

- SLA Penalties: Imposed on service providers who fail to meet agreed-upon performance standards

This shift promises a more robust and diversified revenue stream, ensuring Filecoin’s continued relevance and profitability in the evolving market.

Final Thoughts

As data grows in value, we expect advancements in privacy-preserving machine learning, data-driven business models, and the increasing role of AI agents in unlocking decentralized storage’s potential.

Looking towards 2025, with the upcoming Fast Finality (F3) launch on the mainnet and the continued development of Filecoin Web Services, Filecoin is set to play a central role in shaping the future of data and AI within decentralized ecosystems. We expect to see these advancements positioning Filecoin beyond storage and unlocking a sustainable economic model through new revenue streams generated by FWS.

To stay updated on the latest in the Filecoin ecosystem, follow the @Filecointldr handle or join us on Discord.

Many thanks to HQ Han and Jonathan Victor for reviewing and providing valuable insights to this piece.

Disclaimer: This information is for informational purposes only and is not intended to constitute investment, financial, legal, or other advice. This information is not an endorsement, offer, or recommendation to use any particular service, product, or application.