The Decentralized Storage space is rapidly evolving. Filecoin is at an important moment – and in this blog we propose both areas for the ecosystem to double down on and ways we can track that progress. It is by no means exhaustive, but written from the vantage point of having been embedded in the Filecoin ecosystem for many years, gathering feedback from users, builders and the community, and having thought deeply about what is needed as the network moves forward.

The blog is organized in the following sections:

- What matters for Filecoin in 2024

- Why these matter and how to measure progress

It is our hope that with the right north star, teams will be able to better coordinate and identify convergences between project-level interests & ecosystem interests. The proposed framework and metrics should make it easier for capital and resource allocators in the ecosystem to evaluate the level of impact each team is creating, and distribute capital and resources accordingly. For startups, this can help frame where broader ecosystem efforts may dovetail into your roadmap and releases.

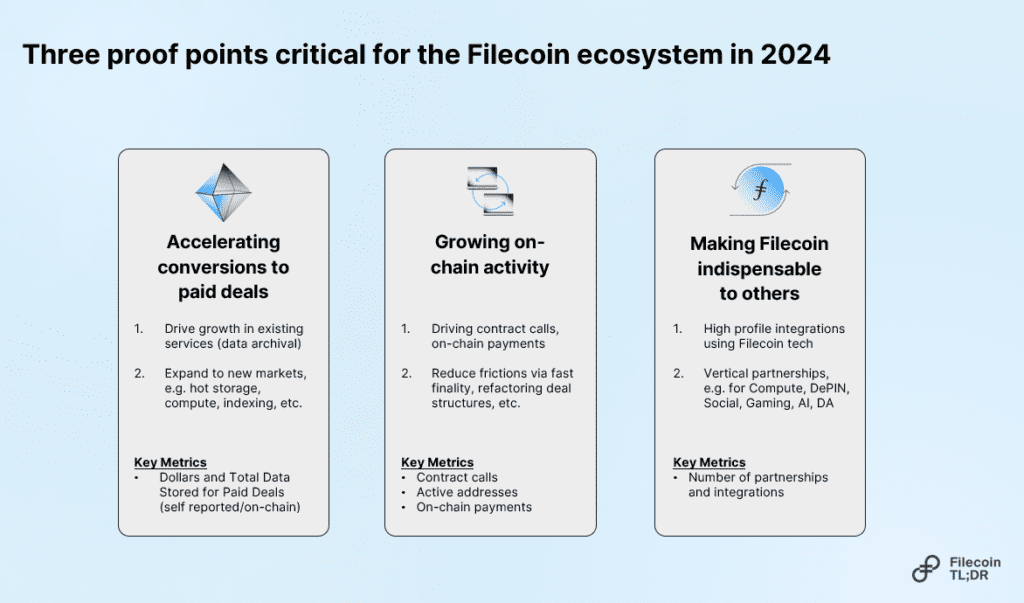

WHAT MATTERS IN 2024

- Accelerating conversions to paid deals: Helping Filecoin providers increase their paid services (storage, retrieval, compute) is critical for driving cashflows into Filecoin and to support sustainable funding of its hardware outside of token incentives.

- Growing on-chain activity: Filecoin is not aiming to be just another L1 fighting over the same use cases. But it does have a unique value proposition as a base layer with “real world” services anchored into it. This enables new use cases (programmable services, DeFi around cash flows, etc.) that are unique to Filecoin. Building out and growing adoption of these services can help prove that Filecoin is not just “a storage layer”, but an economy with a stable set of cash flows.

- Making Filecoin indispensable to others: Bull cycles mean velocity is critical – as is making Filecoin an indispensable part of the stack for more teams. There are many emerging themes to capitalize on (Chain Archival, Compute, AI) – and Filecoin positioning itself matters. The ecosystem collectively wins when more participants leverage Filecoin as a core part of their story. For individual teams, this means that shipping to your users matters. At the ecosystem level, it means orienting efforts to unblock the teams closest to driving integrations and building services on Filecoin.

The verticals in our framework remain relatively high-level – and many of these objectives will have their own set of tasks. But it is more critical first, for the ecosystem to be aligned that this is the right set of verticals to progress against. We dive into each vertical and some tangible metrics that the ecosystem should start tracking against.

WHY THESE MATTER AND HOW TO MEASURE PROGRESS

1) Accelerating conversion to paid deals

As a storage network – Filecoin should maximize the cashflows it can bring into its economy. Having incentives as an accelerant is fine – but without having a steady (and growing ramp) of paid deals Filecoin can’t achieve its maximum potential.

Paid deals (when settled on-chain) are a net capital inflow into the Filecoin economy that can be the substrate for use cases uniquely possible in our ecosystem. DeFi as an example has a real opportunity to provide actual services to businesses (e.g. converting currencies to pay for storage).

There are two main paths that we can drive growth of paid services:

- Drive growth in existing services (data archival)

- Expand to new markets with additional services (hot storage, compute, indexing, etc.)

In both cases, there’s work to be done to reduce friction for paid on-ramps or ship new features that raise the floor (as informed by on-ramps and projects trying to bring Filecoin services to market). It is critical that the Filecoin ecosystem collectively prioritizes the right efforts to make Filecoin services sellable, and allocate resources accordingly.

There are already a number of teams making substantial progress on this front (CID.Gravity, Seal Storage, Holon, Banyan, Lighthouse.storage, Web3Mine, Basin, among others) – and we can best measure progress by helping reduce their friction and helping drive their success.

We propose measuring success for this vertical in two forms:

- Dollars and Total Data Stored for Paid Deals (self reported)

- Dollars and Total Data Stored for Paid Deals (on-chain)

There are a number of initiatives from public goods teams along these efforts for the quarter (Q2 2024) which include:

- FilOz: is working on a FIP for new proofs to reduce storage costs and dramatically improve retrieval speeds

- DeStor: is helping drive enterprise adoption for business ready on-ramps

- Ansa Research, Filecoin Foundation, etc.: Web3 BD support for ecosystem builders

- Targeted grant funding for efforts that directly support growth of sustainable on-chain paid deal activity

2) Growing on-chain activity

Filecoin, as an L1, has more than just its storage service. Building a robust on-chain economy is critical for accelerating the services and tooling with which others can compose. In the Filecoin ecosystem, we have a unique opportunity in that there are real economic flows to enable via paid on-chain deals.

Centering our on-chain economy around supporting those flows – be it from automating renewals, designing incentives for retrievals, creating endowments for perpetual storage, or building economic efficiency for the operators of the network – can lead to compounding growth as it creates a flywheel.

As Filecoin owns more of its own economic activity on-chain, value will accrue for the token – enabling ecosystem users to use Filecoin in more productive ways, generating real demand for services inside the ecosystem.

We propose the following metrics for us to collectively measure success:

- Contract calls

- Active Filecoin addresses

- Volume of on-chain payments

There are notable builders already seeding the on-chain infrastructure to leverage some of these primitives (teams like GLIF working on liquid staking, Lighthouse on storage endowments, and teams like Fluence enabling compute).

There’s a set of improvements that can dramatically reduce friction for driving on-chain activity, and there several efforts prioritized against this for Q2 2024:

- FilOz: F3 to bring fast finality to Filecoin can both improve the bridging experience, and enable more “trade” between Filecoin and other economies (e.g. native payments from other ecosystems for services in Filecoin).

- FilOz: Refactoring how deals work on Filecoin to enable more flexible payment (e.g. with stablecoins)

- FilPonto, FilOz: Reducing EVM tech debt to substantially reduce friction for builders porting Solidity contracts onto Filecoin (and hardening the surrounding infrastructure for more stable services)

3) Making Filecoin indispensable to others

This vertical is broad, but we would argue that there are two key ways to be consider the impact that the Filecoin ecosystem is driving:

- The first is along high profile integrations, where Filecoin is critical to the success of the customer and its proposition. It is especially critical for the ecosystem to provide the necessary support for these cross-chain integrations.

- The second is along specific verticals, where there is a large and growing trend in activity; Filecoin is uniquely positioned to provide value here, both in terms of the primitives it has, as well as in its cost profile and scale

- Opportunities are brimming in Web3 at the moment, and the ecosystem should rally workstreams around on-ramps that are making Filecoin integral to narratives such as Compute, DePIN (sensors), Social, Gaming, AI, and Chain Archival.

- Opportunities are brimming in Web3 at the moment, and the ecosystem should rally workstreams around on-ramps that are making Filecoin integral to narratives such as Compute, DePIN (sensors), Social, Gaming, AI, and Chain Archival.

We propose that the metrics to evaluate for Filecoin indispensability as:

- Number of partnerships and integrations

There are a number of efforts from ecosystem teams aimed at helping onramps succeed on this front in the quarter (Q2 2024):

- Ansa Research, Filecoin Foundation, DeStor and others: Forming a new working group to accelerate shared ecosystem BD and marketing resources

- Shared BD resources for builders in the Filecoin ecosystem

- Shared Marketing resources and amplification (#ecosystem-amplification-requests in the Filecoin slack) to help signal boost ecosystem wins

- Community Discord to help expand accessibility, visibility, and drive community engagement

FINAL THOUGHTS

After reading the above, we hope that the direction of Filecoin in the coming year is clearer. Filecoin is at a pivotal moment where many of its pieces are coming together. Protocols and ecosystems naturally evolve and each stage calls for different priorities and strategies for the next leg of growth. By focusing efforts in the ecosystem, we believe that the Filecoin ecosystem can make its resources and support go that much further.

We are excited for what is to come and how Filecoin can continue to expand the pie for what can be done on Web3 rails. Moving forward, Ansa Research will post periodic updates on the key metrics for Filecoin’s ecosystem progress.

To stay updated on the latest Filecoin happenings, follow the @Filecointldr handle.

Disclaimer: This information is for informational purposes only and is not intended to constitute investment, financial, legal, or other advice. This information is not an endorsement, offer, or recommendation to use any particular service, product, or application.