2023 marked significant shifts in technology and adoption for the Filecoin network. From the launch of the Filecoin Virtual Machine, to other developments across Retrievals and Compute, 2023 lay the foundation for Filecoin’s continued expansion. This blogpost will provide a summary of the notable milestones the Filecoin ecosystem reached in 2023, and in the later portion, growth drivers to watch for 2024.

TL;DR

2023 Retrospective:

- Storage: Active deals reached 1,800 PiB, and storage utilization grew to 20%

- FVM: FVM launch in March 2023 enabled FIL Lending (Staking) which supplied 11% of total collateral locked by Storage Providers; TVL broke USD 200M

- Retrievals: Retrievability of Filecoin data improved, alongside notable releases from Saturn (3,000+ nodes, sub 60ms TTFB) and Station

- Compute: Bacalhau amongst others, demonstrated real-world utility

Themes for 2024:

- Compute, AI and DePIN networks: Synergistic growth of Filecoin together with physical resource & compute networks

- Web2 Enterprise Data Storage: Led by strengthened offerings by teams such as Banyan, Seal Storage, and Steeldome

- Continued DeFi growth: DEXes, Oracles, CDPs, spurred by service revenue coming on-chain

2023 Retrospective

To recap, Filecoin enables open services for data, built on top of IPFS. While Filecoin initially focused on storage, its vision includes the infrastructure to store, distribute, and transform data. The State & Direction of Filecoin, Summarized blog post shared an initial framework for Filecoin’s key components. This framework will serve as an anchor for discussing 2023’s traction.

1) Storage Markets: Active storage deals reached 1,800 PiB with storage utilization of 20%

In 2023, Filecoin’s stored data volume grew dramatically to 1,800 PiB, marking a 3.8x increase from the start of the year. Storage utilization grew to 20% from 3%. Currently, Filecoin represents 99% market share of total data stored across decentralized storage protocols (Filecoin, Storj, Sia, and Arweave).

Growth in Active Storage Deals was driven by two factors:

1) Storing data was easier in 2023. Continued development across on-ramps such as Singularity.Storage, NFT.Storage, and Web3.Storage increased Web3 adoption. Singularity alone onboarded 180 plus clients and 270 PiB of data. This growth was enabled by advances in its S3 compatibility, data preparation, and deal making.

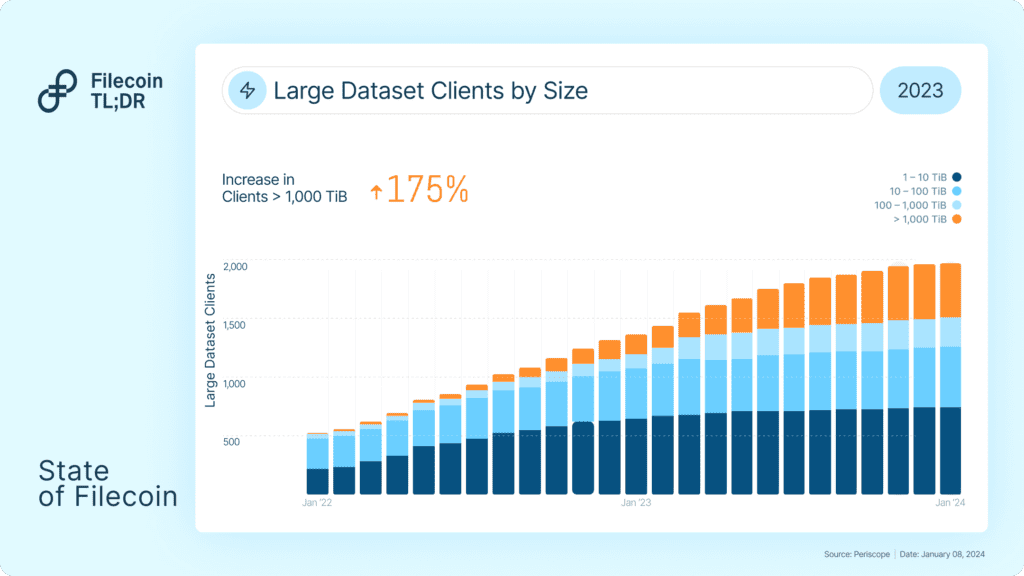

2) Large dataset clients grew exponentially in 2023. Over 1,800 large dataset clients onboarded datasets by the end of 2023, from an initial base of 500 plus clients. 37% of these clients onboarded datasets exceeding 100 TiB in storage size.

In 2023, key clients onboarded include UC Berkeley, Internet Archive, and The Victor Chang Research Institute. This growth supports a thriving storage market that serves as the foundation for retrieval and compute services currently being built.

Source: DeStor

2) Retrievals: Greater reliability for Filecoin Retrievals, alongside releases from Saturn & Station

Filecoin’s retrieval capabilities were bolstered by improvements both in its tooling and offerings. Several teams, such as Titan, Banyan, Saturn and Station, are laying the groundwork for new use cases to be anchored into the Filecoin economy, including decentralized CDNs and hot storage.

Saturn: A Decentralized CDN

Saturn is a decentralized CDN network built on Filecoin, that seeks to address the need for application-level retrievals. The Saturn network currently has over 3,000 nodes distributed across the globe, enabling low-latency content regardless of location.

Distribution of Nodes: 35% in North America, 34% in Europe, 24% in Asia, 7% RoW

Source: Saturn Explorer as of January 08, 2024

Across 2023, Saturn reduced its effective Time-to-First-Byte (median TTFB) to 60 milliseconds. This makes Saturn the fastest dCDN for content-addressable data, with TTFB remaining consistent across all geographies. Saturn was also capable of supporting 400 million retrieval requests on its busiest day of the year.

At the end of 2023, Saturn launched a private beta for customers (clients include Solana-based NFT platform Metaplex).

Station: A Deploy Target for Protocols (Enabling Spark Retrieval Checks)

Station, a desktop app for Filecoin, was launched in July 2023. Station is a deployment target for other protocols allowing DePIN networks, DA layers, and others to run on a distributed network of providers.

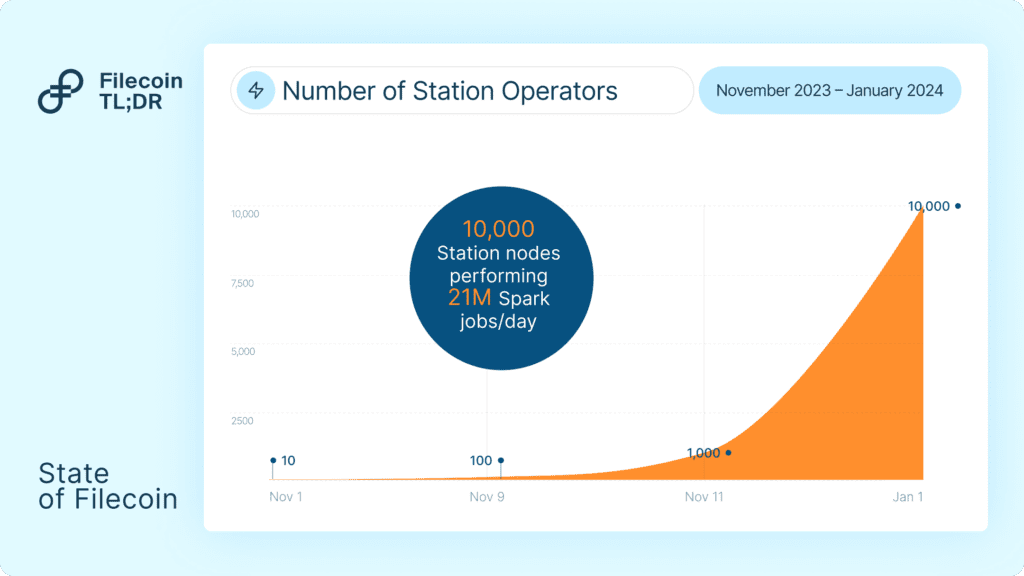

Station’s first module, Spark, is a protocol for performing retrieval checks on Storage Providers (SPs). Spark helps establish a reputational base for SP data retrievability, and supports teams looking to provide a hot storage cache for Filecoin. Since launch in Nov 2023, Spark has grown to 21 million daily jobs on 10,000 active nodes as of January 2024.

3) Filecoin Virtual Machine: The FVM launch introduced a new class of use cases for the Filecoin Network. Early DeFi adoption broke $200 million in TVL.

The Filecoin Virtual Machine (FVM) launched in March 2023 with the EVM being the first supported VM deployed on top. FVM brought Ethereum-style smart contracts to Filecoin, broadening the slate of services anchoring into Filecoin’s block space. Two areas of early adoption have been in liquid staking services (led by GLIF and other DeFi protocols) and micropayments via the FVM.

Liquid Staking

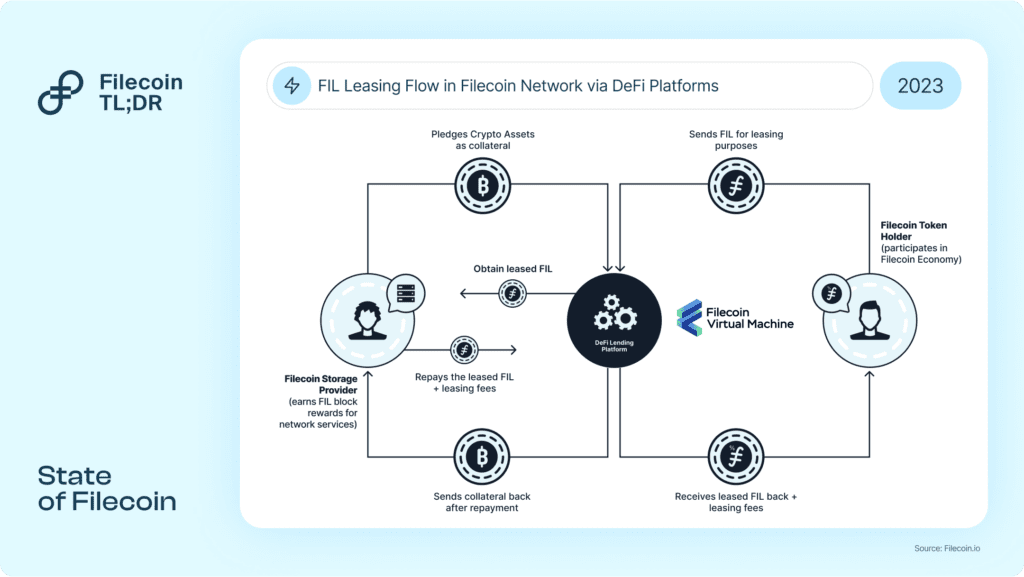

One of the core economic loops in the Filecoin economy is the process of pledging, where SPs put up collateral to secure capacity and data on the network. Prior to the FVM, borrowed Filecoin collateral was sourced through managed offerings from operators like Darma Capital, Anchorage, and CoinList. Post-FVM, roughly a dozen staking protocols have launched to grow Filecoin’s on-chain capital markets.

In aggregate, FVM-based protocols supply almost 11% of the total locked collateral (approx. 19 million FIL) on the network, giving yield access to token holders, and increasing the access to capital for hundreds of Filecoin SPs. From Filecoin’s collateral markets alone, the ecosystem has broken past 200 million in TVL.

Payments

Adjacent to the core storage offering on Filecoin, new services are being built that anchor into Filecoin’s block space. As mentioned in the Retrieval Markets section, two notable services (Station and Saturn) have actually started leveraging FVM for payments in 2023.

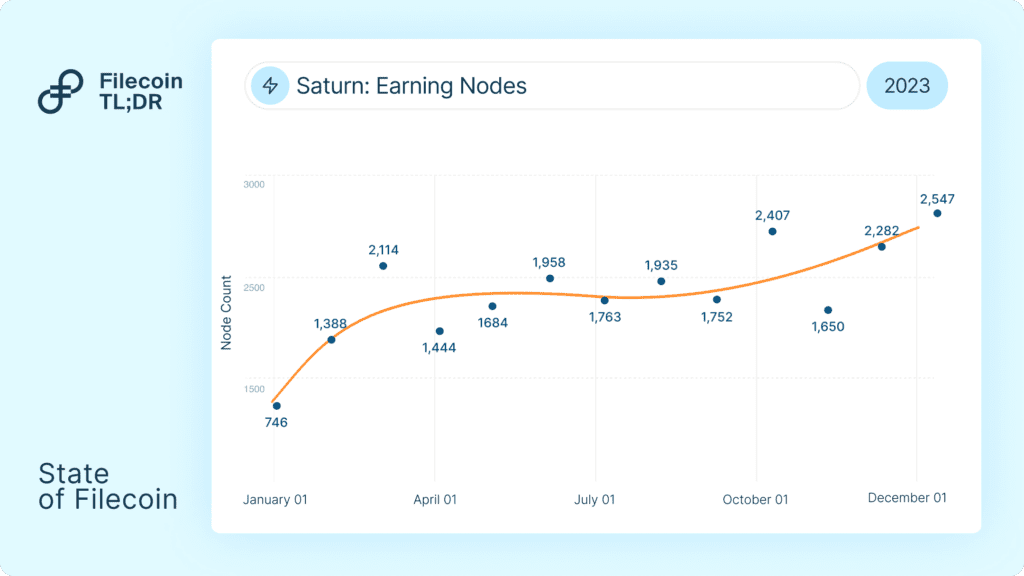

To date, Station users have completed 161 million jobs with more than 400 addresses receiving FIL rewards. Saturn averaged over 2,000 earning nodes in 2023 with 448,905 FIL disbursed to date.

4) Compute: Traction for Decentralized Compute Networks

Filecoin’s design enables compute networks to run synergistically on Filecoin’s Storage Providers. Sharing hardware with compute networks is also valuable to the Filecoin network: (1) sharing allows Filecoin to offer the cheapest storage by running side-by-side with compute operations, and (2) it brings additional revenue streams into the Filecoin economy.

Two key developments made running compute jobs on Filecoin nodes:

- Sealing-as-a-service: Sealing-as-a-service is the process by which Storage Providers (SPs) can outsource production of sealed sectors to third-party marketplaces. This gives SPs greater flexibility in operations and reduces costs of sector production. One marketplace, Web3mine, has thousands of machines participating in its protocol offering cost savings to SPs of up to 70%. On top of the cost savings, the infrastructure built may also eventually benefit SPs by allowing them to leverage their GPUs for synergistic workloads (e.g. compute jobs)

- Reduced Onboarding Costs: Supranational shipped proof optimizations reducing sealing server cost by 90% and overall cost of storage by 40%

On top of these developments, 2023 saw emerging compute protocols building in the Filecoin ecosystem. Two notable examples:

- Distributed compute platform Bacalhau demonstrated real-world utility among Web2 and DeSci clients. Most recently, the U.S. Navy chose Bacalhau to assist them in deploying AI capabilities in undersea operations. Bacalhau is a platform agnostic compute platform intended to run on Web3 and Web2 infrastructure alike. Launched in November 2022, Bacalhau’s public network surpassed 1.5 million jobs and in some cases slashed compute costs by up to 99%

Source: Bacalhau

- Up-and-coming compute networks like Io.net allow ML engineers to access a distributed network of GPUs at a fractional cost of individual cloud providers. Io.net recently incorporated 1,500 GPUs from Filecoin SPs — positioning Filecoin providers to offer their services to Io.net’s customer base. Io.net has over 7,400 users since its launch in November 2023, serving 15,000 hours of compute to users.

Source: io.net

2024 Outlook

2024 will be a critical growth year for Filecoin as groundwork laid in 2023 comes to fruition. Native improvements to storage markets, greater speed of retrievals, new levels of customizability & scalability brought by FVM and Interplanetary Consensus (IPC), all expand the universe of use cases that Filecoin can address.

In a Web3 climate where there is substantial attention on DePIN (and the tying of real world services with Web3 capabilities) these changes will be critical building blocks for even better services. Here are three themes to look for in 2024:

1) Synergies with Compute, AI and other DePIN networks

In 2024, foundational improvements to the network will substantially improve Filecoin’s ability to compose with other ecosystems.

- Fast finality allows better cross-network interactions with app chains in other ecosystems (e.g. Cosmos, Ethereum, Solana).

- Customizable subnets allow for novel types of networks to form on top of Filecoin such as general purpose compute subnets (e.g. Fluence) and storage pools (e.g. Seal Storage).

- Hot storage allows for broader use case support including serving data assets for physical resource networks (e.g. WeatherXM/Tableland), caching data for compute networks (e.g. Bacalhau), and more.

This is all scratching the surface. As the Web3 space and DePIN category grows, Filecoin is well positioned to support new communities that form given its 9 EiB of network capacity and flexibility. There exists a sizable opportunity within physical resource networks producing high amounts of data, such as Hivemapper (over 100M km mapped), and Helium (1 million hotspots globally). Compute networks are also a likely growth area, given the backdrop of a GPU shortage (particularly for AI purposes) in traditional cloud markets.

Source: Messari

2) Focused Growth in Web2 Enterprise Data Storage

Web2 enterprise storage is a unique challenge for decentralized networks – requirements from these customers are not easily supported by most networks. Typical requirements from enterprise clients can include end-to-end encryption, certification for data centers, fast retrievals, access controls, S3 compatibility, and data provenance/compliance. Crucially, these requirements tend to differ across segments and verticals, which means that a level of adaptability is required. Filecoin’s architecture enables it to layer on support for the features these customers need.

A few teams worth keeping an eye on:

- Banyan: Banyan simplifies how enterprise clients integrate with decentralized infrastructure by bundling hot storage, end-to-end encryption, and access controls, on top of a pool of high-performing storage providers. With the Filecoin network, Banyan provides content-addressable storage, which it plans to complement with hot storage proofs by utilizing FVM. This implementation makes Banyan compatible not only for enterprise, but DePIN and compute networks.

- Seal: Seal has established itself as one of the best storage onramps in the Filecoin ecosystem, and is responsible for onboarding several key clients onto the network, such as UC Berkeley, Starling Labs, the Atlas Experiment, and the Casper Network. The team has been one of the driving forces in enterprise adoption to date, and most recently has achieved SOC 2 Compliance. In 2024, they plan on launching a subnet to enable a market for enterprise deals. On the back of their enterprise deal flow, they are positioned to bring petabytes of data into the network over the coming year via their new market.

- Steeldome: Steeldome offers enterprise clients seeking data archival, backup and recovery with an alternative that is cost-competitive, efficiently deployed and scalable. It does so by combining Filecoin in its stack with Web2 technologies, allowing a fuller feature set to complement Filecoin’s cost-effective and secure archival storage. The Steeldome team has succeeded in onboarding clients across insurance, manufacturing, and media. In 2024, they plan to continue that trajectory, while offering a managed service for Storage Providers.

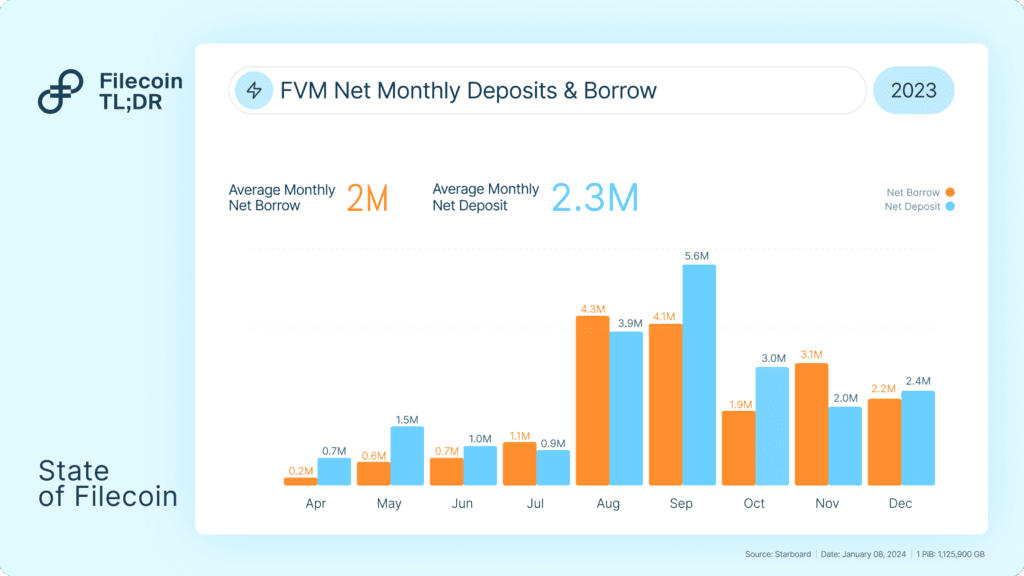

3) Greater On-chain DeFi activity

There is likely to be continued activity in the on-chain economy with an increase in the number and type of DeFi protocols on Filecoin.

- The first protocols will increase service revenues (from Storage, to Retrievals, and Compute) coming on-chain. As previously described, more services are coming online in the Filecoin network, and are utilizing FVM for payments (e.g. Saturn, Station).

- Key releases in 2023, including SushiSwap going live in Nov 2023, and the UniSwap community’s approval of integrating on FVM will lead to more diverse DeFi services coming on-chain. This will include CDPs (Collateralized Debt Positions), and Price Oracles (e.g. Pyth), among others.

Final Thoughts

In 2024, the Filecoin network will experience greater adoption, particularly by Compute, AI and DePIN networks, as well as targeted enterprise verticals. This adoption brings on-chain service revenue and supports the growth of DeFi activity beyond collateral markets. Continued improvements on storage markets, retrievability driven by hot storage proofs and CDN networks, as well as releases by FVM and IPC will enable the teams building on Filecoin to drive this next stage of growth.

To stay updated on the latest in DePIN and the Filecoin ecosystem, follow the @Filecointldr handle.

This blogpost is co-authored by Savan Chokkalingam and Nathaniel Kok on behalf of FilecoinTLDR. Many thanks to HQ Han and Jonathan Victor for reviewing and providing valuable insights and to all the ecosystem partners and teams for their timely input.

Disclaimer: This information is for informational purposes only and is not intended to constitute investment, financial, legal, or other advice. This information is not an endorsement, offer, or recommendation to use any particular service, product, or application.