Introduction and Overview

This blog post explains what Filecoin’s Virtual Machine (FVM) is, why it matters, and how one might evaluate and prioritize the opportunities it unlocks.

- First, we will explain what the Filecoin Virtual Machine is and how Filecoin becoming programmable lays the foundation for composable products and services in the Filecoin economy.

- Secondly, we introduce a framework to categorize the universe of potential FVM-powered use cases into distinct opportunity areas. This section discusses specific opportunities unlocked by the FVM and how venture investors, developers, storage providers and other stakeholders may evaluate and prioritize them.

- In the third section, we explore how, by commoditizing cloud services and by allowing anyone to create and monetize products and services around data, the FVM stands to fully unleash and augment the full potential of a trillion dollar open data economy.

- We conclude by discussing what has energized many hundreds of teams to start building on the FVM, and by providing information on how you can stay up to date on all things FVM.

Please note that this blog post builds on previous posts that explored the Filecoin Virtual machine in the context of the broader Filecoin roadmap, its potential impact on the Filecoin economy and its potential to unlock new use cases in an economy of open data services. You may find it useful to review these articles for further exploration of the topics discussed.

1. The FVM brings user programmability to Filecoin creating a watershed moment for innovation

Filecoin’s larger roadmap aims to turn the services of the cloud into permissionless markets on which any provider can offer their services. The launch of smart contracts (also known as ‘actors’) on FVM on March 14 2023 is a critical component of this larger vision as FVM allows for user programmability around the key services of the Filecoin network: Large-scale Storage, Retrieval, and Compute over data.

What’s exciting about FVM is the ability for any developer¹ to deploy smart contracts on the network. One may compare this to the moment that phones became programmable: The ability to write and install apps significantly augmented what people could do with phones and allowed the devices to go far beyond the capabilities of their pre-installed, hard-coded software. It was a watershed moment for innovation.

Similar dynamics stand to unfold when Filecoin becomes programmable by anyone through FVM. Since Filecoin’s storage market is currently the primary service anchored into the Filecoin blockchain today, the first big unlock will likely be programming around the state of Filecoin’s storage deals. Specifically, anyone will be able to (within certain limits) write software on what, how, when and by/for whom data is stored via Filecoin, the world’s largest open access storage network.

While the FVM does not directly interact with the data stored on the Filecoin network (just its metadata!), it will enable automation of storage and related services (e.g. off-chain data indexers, oracles) and settlement of value. This automation unlocks many new use cases. Illustratively, find a few select opportunities (Perpetual Storage, DataDAOs, Filecoin staking) that arise from assembling the different building blocks that the FVM provides access to below.

These illustrative recipes for use cases can be endlessly re-combined with each other and other components (e.g., developer tooling, end-user interfaces etc.). Additionally, they may eventually also leverage other building blocks of the Filecoin economy which anchor into the same blockspace (e.g., retrieval of and computation on content-addressed data) as well as those of other economies (e.g., via cross-chain bridges or oracles). These combinations will result in the emergence of ever more sophisticated services.

2. How we see the use cases unlocked by the FVM

The use cases unlocked by the FVM are loosely grouped into the following opportunity areas:

- Data onboarding & management: e.g., tools automating storage deal-making to unlock use cases like perpetual storage

- Data curation & monetization: e.g., tools facilitating the collective creation, curation and monetization of valuable datasets

- Decentralized finance: e.g., to provide access to collateral for the thousands of storage providers offering services on the network and to create new opportunities for token-holders to participate more actively in the Filecoin economy

- Network participant discovery and analytics: e.g., storage provider reputation services or data retrievability oracles that create differentiation opportunities and may enhance the reliability of the decentralized cloud for its users

- Integration, interoperability and other services: e.g., cross-chain bridges to integrate with other economies or NFT-standards with built-in storage guarantees, developer tooling and more

It is important to note that due to the recombinant nature of FVM-powered use cases and web3 in more broadly, businesses may cut across several of these opportunity areas.

One of the unique advantages of FVM-powered services starting up in the Filecoin economy is access to a large number of storage providers seeking to boost their profitability. In February 2023, storage providers on the Filecoin network had collectively locked up 130M+ FIL in collateral to secure their commitments to keeping the network and their clients’ data safe.

Additionally, storage providers have collectively invested millions of dollars to stand up the data centers that provide many exabytes of capacity. Partly due to the absence of DeFi solutions, access to collateral and other financing is relatively difficult today.² As a result, services that lower these costs and reduce complexity for storage providers and/or unlock new revenue streams represent sizable addressable markets. This advantage is also a distinguishing dynamic that makes Filecoin a differentiated L1.

To lower cost, DeFi lending services may provide cheaper access to capital (which is required for collateralizing storage deals) by using storage provider reputation scores to improve underwriting or by using smart contracts to enforce repayment (e.g., by using future block rewards as collateral) directly to those lenders that made them possible. Such services³ also stand to benefit from being able to tap into the large number of token-holders — many of which are eager to participate in the Filecoin economy more actively.⁴ Furthermore, data on-boarding and management services may lower costs for storage providers by lowering storage client acquisition costs (e.g., via deal aggregators) and/or by reducing the overhead of being a Filecoin storage provider (e.g., by modularizing the operations).

FVM-powered services may also increase SP revenue by enabling data access or encryption solutions (e.g., Medusa, Fission, Lit or Lighthouse) which make Filecoin solutions viable for new customer segments, by giving SPs more opportunities to differentiate (e.g., via reputation or compliance-certification tools), increasing the duration of storage deals (potentially in perpetuity) and allocating Fil+ datacap more efficiently.

Cross-chain bridges and messaging to other (web3) ecosystems which facilitate the importing and exporting of services to and from the Filecoin economy also represent large opportunities for growth — both in utility for the Filecoin network (and thus in demand for Filecoin blockspace) and for increasing utility for web3 overall. In the near term, developers may also capitalize on opportunities around the tooling that makes building the services outlined above more feasible.

Collectively, these opportunities represent markets with hundreds of millions of dollars in revenue potential. Different considerations will inform how the stakeholders may prioritize the development of each opportunity area. Additionally, stakeholders may strategically sequence the development of different opportunity areas to maximize impact. The below framework provides an overview of potential dimensions that one may use to assess opportunities unlocked by the FVM.

3. Empowering more people to create and capture value around data to unleash the full potential of an open data economy

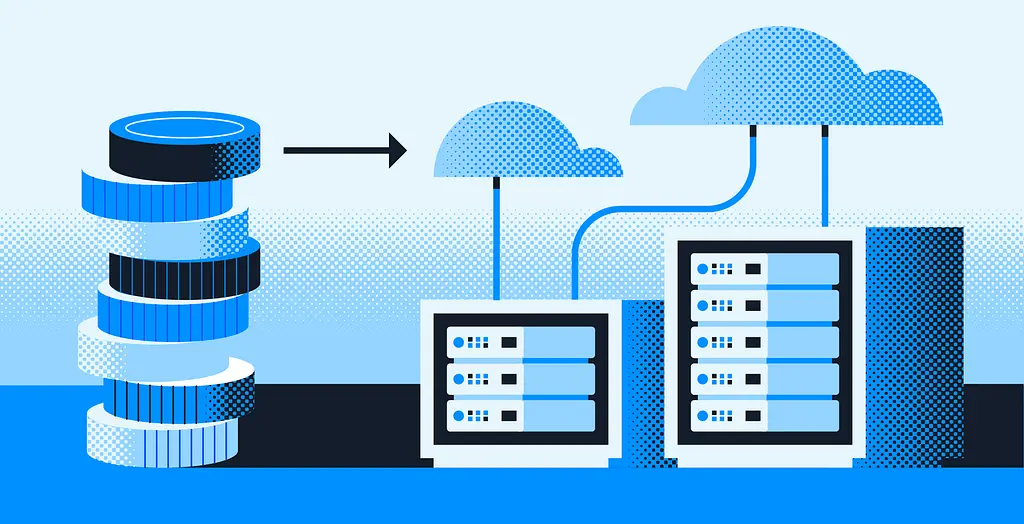

Importantly, Web3 and Filecoin, and the FVM specifically, will continue to commoditize the services of the cloud and allow for better value attribution in the data economy. This section explains why this commoditization is needed and how it opens up access to the data economy and augments the ways in which value can be created, captured, and more equitably shared.

Let the data economy be defined broadly as covering businesses around data analytics and transformation (e.g., software for encryption, transcoding and more), data access and monetization (e.g., on-demand streaming services), the financial services facilitating transactions between market participants as well as the sale of hardware required to power these businesses.

Today, the core tenets underpinning this data economy (i.e., cloud storage and compute, content-delivery networks and more) are dominated by a few large companies. These organizations are successfully leveraging economies of scale to moat their businesses. The resulting dominance of a few large players has not only created central points of failure, but also stifled innovation and kept prices artificially high.

Web3, Filecoin, and the FVM stand to challenge these dominant players: The composability and power of crypto-economic incentives allowed the Filecoin community to rapidly bootstrap into existence an ever-expanding and competitively priced network of storage providers. Filecoin’s open access storage network is already the world’s largest of its kind, its capacity eclipsing even some publicly traded centralized storage providers. As Filecoin moves closer to its vision, infrastructure anchoring into the Filecoin network will also commoditize the services around content-delivery (e.g., via Filecoin Saturn) and compute over data (e.g., via Bacalhau).

Secondly, in today’s data economy value creation often stems from collectively generated datasets (think: users creating content for social networks and other signaling interest for that content), the capture of that value is largely privatized in today’s data economy. This is due to the fact that well-functioning mechanisms that would let data originators participate directly in the capture of value around datasets that they collectively create did not successfully emerge in web2. Instead, the most effective in monetizing collectively created datasets turned out to be advertising.

Web3 tech is, however, structurally better positioned to trace and retroactively reward contributors (even for data points with small marginal value) by using its decentralized ledgers. With the FVM, specifically, any number of unaffiliated parties could use the Filecoin token (or a FVM-powered L2 abstraction thereof) to form an incentivized collective around the creation, preservation and monetization of datasets (that otherwise may never emerge):

- Imagine individuals monetizing their contributions to the training data of an AI model or to a social graph

- Or researchers using the proceeds of selling access to a database of bacterial pathogens (which may be used to inform antibiotic diagnostics or improve drug discovery) to finance the continued curation and maintenance of said database

- Or an ever-expanding encyclopedia rewarding its most active contributors directly as opposed to letting the value flow through an intermediary foundation

As projects like these emerge, the ability to capture value will likely depend to an ever greater degree on having access to proprietary datasets. Additionally, the open nature and the composability of such services also allows users to preserve their agency to exit, remain loyal to, or voice their concerns about data-centric services. This agency preservation will force institutions to think about dataset privacy and sharing in more sophisticated ways than “just trust us”. It may also result in allowing users that own their data to keep a (larger) share.

In summary, the trends around commoditization and better value attribution fueled by FVM and Filecoin will not only lead to fiercer competition and more pressure to innovate across all sectors of the data economy, but also solidify Filecoin’s position as the Layer-1 blockchain uniquely poised to power this open data economy.

Conclusion: FVM creates fertile ground for accelerated growth of the Filecoin ecosystem

FVM stands to unlock the development of applications, markets and organizations that will eclipse the scale and breadth of services offered by centralized cloud providers.

This potential has energized the community tremendously: Weeks before the official launch of the FVM, there are hundreds of teams building with the FVM on the testnet. Additionally, FVM-specific hackathons (e.g., Spacewarp) leading up to the launch of the FVM saw the highest registration numbers for a Filecoin-exclusive hackathon ever.

The Filecoin community continues to foster a radically recombinant ecosystem that accelerates the best ideas. FVM is highly cross-compatible thus catalyzing the adoption of Web3 technologies alongside and in partnership with other ecosystems and L1 blockchains.

Similar to how a computer may support multiple operating systems, Filecoin’s Virtual Machine will support multiple runtimes. The first runtime to launch will be the Filecoin Ethereum Virtual Machine (FEVM). This eases the ramp-up for EVM developers who can leverage tried and tested developer tooling infrastructure and port over existing EVM-based smart contracts.

These all are compelling reasons to build with the FVM. If you are interested in following along on what teams are building with the FVM, check out this non-exhaustive list. Also, review the Space Warp initiative to learn more about the program leading up to the launch of Filecoin’s Virtual Machine, including FVM-specific hackathons, grants, community leaderboards and acceleration programs. To familiarize with the technical details around the FVM consider visiting fvm.filecoin.io or watching one of the many videos introducing the technology.

Disclaimer: Personal views and not reflective of my employer nor should be treated as “official”. This information is intended to be used for informational purposes only. It is not investment advice. Although we try to ensure all information is accurate and up to date, occasionally unintended errors and misprints may occur.

[2]: The absence of better opportunities to more optimally allocate FIL in the Filecoin economy, may explain why the locking rate of Filecoin (38%) is lower than that of many other Layer-1 blockchains (often >60%)

[3] For example, check out Glif’s work on Filecoin pools