Editor’s Note: This blogpost is a summarised repost of the original content published on 25 April 2025, by Molly Mackinlay from FilOz. Founded in 2024, FilOz is a team of 14 protocol researchers, engineers, TPMs, and community engineers focused on securing, upgrading, and expanding the Filecoin network.

Introduction

Nearly five years into its launch, Filecoin – now the world’s largest decentralized storage network, caters to more than one type of user. It serves a diverse range of customer segments where adoption and traction are already taking hold. A strong signal of product-market fit is paying demand – users who see enough value to pay for the service.

This blogpost offers a comprehensive look at Filecoin’s Ideal customer profiles (ICPs), analyzes current adoption trends, identifies high-opportunity areas based on payment signals and data volume, and outlines key strategies to drive future client success.

Identifying and Targeting Ideal Customer Profiles (ICPs)

At the heart of this demand push is a clear focus on Ideal Customer Profiles (ICPs) – specific categories of users the network is targeting for adoption. These ICPs represent use cases where Filecoin’s decentralized storage offers immediate value. Paying demand is one of the strongest indicators of product-market fit, and Filecoin is seeing traction in several key segments:

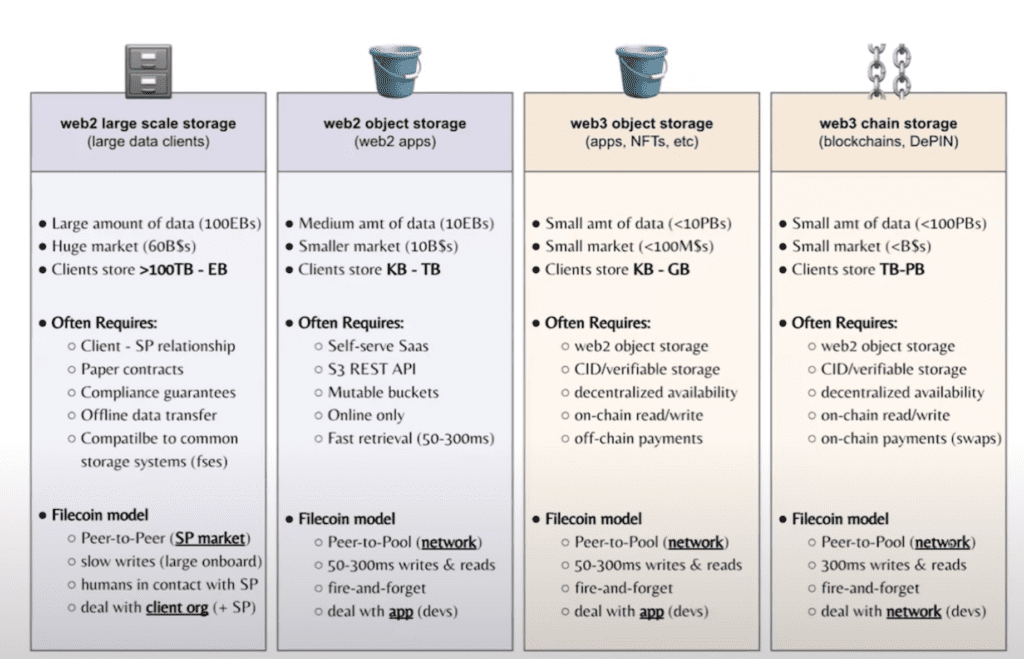

Four Core Vertical Markets:

- Large-Scale Data Clients (Primarily Web2):

Traditionally focused on archival storage, now evolving toward faster reads/writes due to AI workloads. Think multi-exabyte archives with 24-hour retrieval tolerances. - Web2 Object Storage (e.g., AWS S3 alternative):

Demands fast access, pricing competitiveness, Snowflake integrations, and strict controls over data locality—especially amid rising geopolitical tensions. - Web3 Object Storage:

Adoption from decentralized websites, NFTs, social apps, and AI agents. Nascent potential includes data DAOs and decentralized AI use cases. - Web3 Chain Storage:

Early traction from chains like Solana and Cardano, with data from Ethereum L2s scaling up to terabytes and petabytes. Strong potential, but more robust on-ramps are needed.

It’s also worth noting that beyond these four verticals, DePINs – particularly those collecting large volumes of consumer data are a key focus for 2025. In addition, edge computing and AI are emerging as high-potential sectors, driven by their rapidly growing, data-intensive workloads.

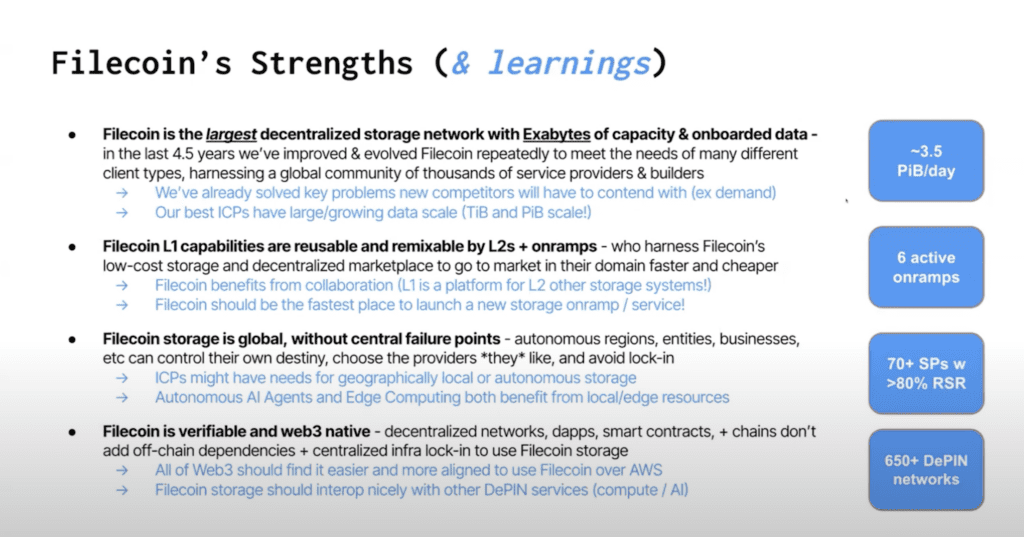

Mapping Filecoin’s Strengths to Its Most Promising Use Cases

To effectively serve the right customer segments, it’s essential to ask: what core strengths does the Filecoin network offer – and how can those be applied to the ideal customer profiles that stand to benefit most?

The following slide summarizes Filecoin’s strengths (and its learnings):

Building on Filecoin’s core strengths, the next slide highlights the key Ideal Customer Profiles (ICPs) driving real-world adoption today. It identifies which client segments are actively paying, which have rapidly growing data volumes, and where early adoption is gaining momentum:

This alignment between strengths and needs is essential for driving meaningful adoption and long-term growth.

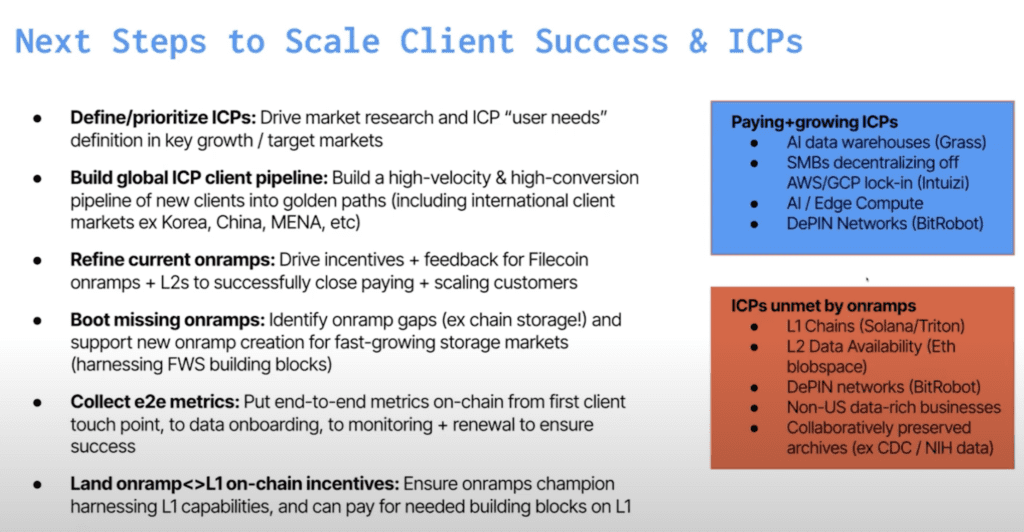

Scaling Client Success & Ideal Customer Profiles (ICPs)

While Filecoin has attracted paying users across various sectors, scaling from a few customers to a broad, thriving user base remains a key challenge. A major bottleneck is the lack of strong on-ramps specialized Layer 2 solutions – that serve high-volume, fast-growing ICPs like Web3 chain storage. This gap presents a clear opportunity for builders to develop targeted solutions.

Scaling client success ties directly to Filecoin’s 2025 core KPIs:

- Revenue from on-chain paid storage deals: The main indicator of product-market fit. Despite off-chain payments, on-chain revenue is near zero. Bridging this gap with Proof of Data Possession (PDP) and Filecoin Web Services (FWS) is critical.

- Growing a satisfied client base: Paying clients exist, but better transparency and dashboards are needed to track success.

- Increasing service activity and value accrual: Tools like the USDFC stablecoin and FIP-100 protocol are in place, but accelerating on-chain payments and fee flows is essential.

To achieve this growth, several strategic steps are required, as outlined below:

Conclusion

Filecoin is actively transitioning from a capacity-focused infrastructure to a user-driven ecosystem. With a sharpened focus on ICPs, a maturing network of on-ramps, and powerful protocol innovations, it’s well-positioned to scale demand and adoption. Key challenges, especially around on-chain revenue and retrievability remain, but the foundation for sustained growth is rapidly taking shape.

To learn more about State of Client Adoption and ICPs for Filecoin, explore the following talk that happened during FDS-6:

- State of Client Adoption and ICPs (by Molly Mackinlay, FilOz)

Disclaimer: This information is for informational purposes only and is not intended to constitute investment, financial, legal, or other advice. This information is not an endorsement, offer, or recommendation to use any particular service, product, or application.