Introduction

The Filecoin network launched in October 2020, introducing an incentive layer to the IPFS protocol and enabling open services for data. Today, the network primarily focuses on storage as an open service — however, an earlier blog post summarizing the direction of the network presents the larger vision for Filecoin to also “include the infrastructure to store, distribute, and transform data.”

The Filecoin “master plan” to execute this vision begins with accumulating a critical mass of hardware resources (storage capacity and compute power). This is important, as the only way web3 infrastructure will credibly subsume (not just compete with) the traditional cloud, is if it can operate at orders of magnitude and scale that exceed current offerings. While no web3 protocol has achieved this yet, Filecoin has made the most meaningful progress.

Furthermore, to drive long-term demand for network resources (capacity, retrieval, and compute power), it’s critical to bootstrap the network with useful data and to develop the software and tooling to enable compute and composable services on top of data. Ultimately, the demand for these services will be the basis for a robust economy on top of the Filecoin blockchain.

Filecoin’s tokenomics were designed with this long-term vision in mind and have helped incentivize the network’s rapid growth and development; to date, the network contains >16 EiB of committed storage capacity, with an explosion of ecosystem developments driving demand for network resources. This growth and continued success is due to the efforts of the Filecoin community, an interconnected network of Storage Clients, Developers, Storage Providers (SP’s), Ecosystem Partners, and Token Holders.

Filecoin the Token

This global digital economy also requires a singular valid currency for transactions. Since Filecoin is a permissionless market with cryptographically verifiable goods, design constraints could only be satisfied with a native utility token, the filecoin (see Engineering the Filecoin Economy for further color). The FIL token serves a number of functions:

- Pays for messages on-chain.

- Used as collateral creating economic incentives for reliable data storage over time and to secure the blockchain (and subnets or “shards” once Interplanetary Consensus goes live!).

- Burned to regulate shared resources (blockspace).

Unlike other storage networks, the Filecoin token is primarily concerned with incentivizing reliable services and facilitating the on-chain economy. The storage market exists off-chain, but is anchored on-chain by messages containing cryptographic proofs of storage. Crucially, this means that the token can accrue value without creating undue pressure on users of the network’s various services (storage, retrieval, compute, etc), while Token Holders can still benefit from FIL consumption due to increased utilization (i.e. demand for blockspace).

Cryptoeconomics for Token Holders

Filecoin’s Token Allocation

Filecoin’s cryptoeconomic constructions help ensure that value accrual for participants aligns with the long-term utility of the protocol. As such, the initial allocation of Filecoin at network launch was designed to support a protocol that incentivizes sustainable value creation (see below).

As of current protocol specifications, a maximum of 2 Billion FIL will ever be created; of this, 70% was allocated for storage and related services (i.e. minting tokens to reward Storage Providers), and 20% (vesting over 6 years, starting October 2020) was allocated to Protocol Labs and the Filecoin Foundation to support network development, adoption, and ecosystem growth. The remainder was FIL allocated to SAFT investors, which began vesting in October 2020 over time periods ranging between 6 months and 3 years.

2 Billion FIL is the maximum amount that could theoretically be minted and vested. However, it may not be the amount of FIL that enters the network’s circulating supply:

- The 300 Million FIL held as a Mining Reserve would require a protocol upgrade to be tapped — meaning the community determines how much (if any) of this should be released.

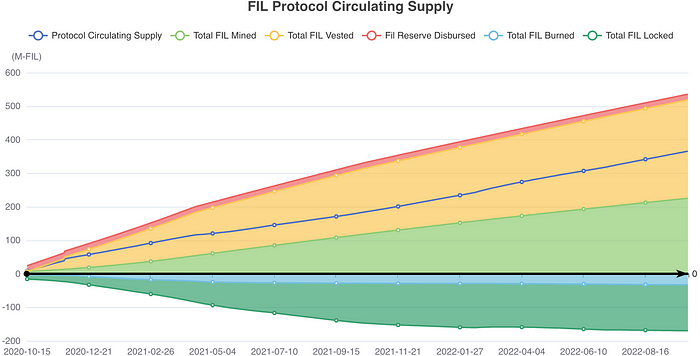

- The growth of the network requires utilization and consumption of the token, reducing the available token supply. As of September 2022 end, ~520 Million FIL has been minted or vested; of this, approximately 70% is in circulation since significant amounts of FIL is burned (permanently removed from circulation) due to network transaction fees, or locked as collateral to secure the network and incentivize reliable storage. As the network matures, the rate of token emissions (vesting and minting) is expected (and was designed) to taper, since Filecoin has finite vesting schedules and a minting model in which emissions are indexed to network growth.

Token Supply: Sources and Sinks

Token Holders can benefit from an understanding of the sources and sinks that determine token supply over time because it potentially informs their relative purchasing power.

Minting, Vesting, Locking, and Burning contribute to the net inflow or outflow of tokens from the circulating supply. See below for the evolution of Filecoin’s token supply since mainnet launch.

Currently, the network is expanding; tokens vesting for The Filecoin Foundation and Protocol Labs support ecosystem development and growth, while block rewards for Storage Providers subsidize the onboarding of deals and storage capacity. This presents a tremendous opportunity for Token Holders to participate in the growth of the ecosystem since they can lend to SP’s, facilitating SP’s much-needed access to FIL, and share in resulting network rewards. In this way, Token Holders can index themselves to token emissions whilst also supporting network growth and advancing Filecoin’s vision.

Ecosystem Roadmap: Implications for Token Holders

We are at an incredibly exciting point in the Filecoin Ecosystem, with continued improvements in User Programmability, Data Onboarding, Data Retrievability, Scalability, and Computation slated for implementation over the next 4 quarters. These initiatives should have positive effects for Token Holders through supporting client demand, unlocking various network use cases, and ultimately driving usage of the token. Some of these important improvements as well as their potential economic implications are discussed below.

Filecoin Virtual Machine (FVM)

The Filecoin Virtual Machine unlocks boundless possibilities, ranging from programmable storage primitives, to cross-chain interoperability bridges, to data-centric Decentralized Autonomous Organizations (DAOs), and Layer 2 solutions. In short, this means smart contracts and user programmability are coming to Filecoin! Slated for release in H1 2023, this upgrade to the network should positively impact Token Holders since it may increase FIL’s use cases, and will likely impact the “sinks” component of the circulating supply equation (FIL Locked and Burnt).

FVM and “Sinks” to Token Supply

As long as there is action or utility on the network, FIL tokens will be consumed (“burned”) to compensate for the computation and storage resources on-chain messages consume. Introducing smart contract capabilities may increase demand for block space, resulting in increased burnt FIL. This rate of token consumption is in the hands of the community as network participants compete for on-chain resources.

Furthermore, the FVM protocol upgrade may increase the amount of FIL put to use and/or locked. Currently, the majority of FIL locked on the network comes from Storage Provider collateral. FVM introduces the possibility of substantial funds locked to support various smart contract applications. Decentralized Finance (DeFi) protocols are just a subset of applications that may leverage Filecoin’s Proof of Useful Work chain, not only increasing token burn, but also generating new use cases for locking/staking FIL.

The FVM is unique in that it brings expressivity to the Filecoin network — while today you can contract a storage provider to store your data, with the FVM you can add additional rules, automation, and composability with other services (e.g. DeFi). As other components of the roadmap land (retrieval markets, compute over data, etc) — we expect the FVM to facilitate more sophisticated offerings leveraging Filecoin’s base primitives, promoting broader network adoption.

Note: For a flavor of what might be possible, this tweet thread might help elucidate how one might use smart contracts and the base primitives of Filecoin to build more sophisticated offerings.

Filecoin Plus and Data Onboarding

Filecoin Plus (FIL+) emerged as a pragmatic solution to incentivize productive use of the Filecoin Network. Since it is difficult to algorithmically distinguish real useful data from generated randomness, FIL+ introduced a layer of social trust to the network. In the FIL+ program, clients that undergo a verification process are granted a novel resource, DataCap, with which they can spend and make storage deals with SP’s. SP’s are incentivized to enter into storage deals with Clients who spend DataCap, because FIL+ deals boost the amount of block rewards they receive as compared to regular (non-FIL+) deals, or through committing storage capacity to the network. In order to receive these boosted rewards from FIL+, Storage Providers put up more collateral (roughly 10x the collateral for non-FIL+ storage sectors), and lock more tokens on the network.

Year to date, we have seen robust growth in data from FIL+ clients, indicating increasing amounts of useful data onboarded.

From a tokenomics perspective, this trend persisting may increase tokens locked on the network and decrease the circulating token supply. More importantly, as the Filecoin network grows towards its mission of storing useful data, so too may the consumption and utilization of the token.

Interplanetary Consensus

Interplanetary Consensus (IPC) is an upcoming network upgrade designed to increase the use cases that Filecoin can support while also improving the network’s scalability, throughput, and finality. An exciting blockchain innovation that horizontally scales the chain with subnets (shards), IPC also has some potential cryptoeconomic implications, and may increase the:

- amount of FIL burned while also decreasing gas fees for users due to scalability improvements coupled with FVM utilization.

- amount of FIL locked (or staked) as collateral in order to secure subnets.

- demand for FIL consumption with shards supporting customized on-chain use cases.

Conclusion

As a novel data storage and application network, Filecoin’s mission is to create a decentralized, efficient, and robust foundation for humanityʼs information. Developments in the Filecoin ecosystem to support this mission are numerous, ongoing, and can positively impact Token Holders. By design, the protocol’s cryptoeconomics intend to reward long-term participation and contribution to the network. Community participants can benefit from understanding the tokenomics, and, in particular the sources of token inflow and outflow that undergird the token economy. Looking forward, continuing improvements to the protocol may present new and exciting use cases for the network and the token, potentially enabling further Token Holder engagement and positively driving the value proposition of this fast-growing ecosystem.

Disclaimer: Personal views and not reflective of my employer nor should be treated as “official”. This information is intended to be used for informational purposes only. It is not investment advice. Although we try to ensure all information is accurate and up to date, occasionally unintended errors and misprints may occur.

Many thanks to Jon Victor (@jnthnvctr), as well as to the TLDR and CryptoEconLab teams for their help shaping this.