Editor’s Note: This blogpost is a summarised repost of the original content published on 25 April 2025, by HQ Han from Ansa Research. Ansa Research is a research firm focused on distributed infrastructure. The firm covers digital networks aiming to rebuild how internet infrastructure operates.

Executive Summary

Filecoin has now entered the next phase of development, focusing on users, demand generation and adoption.

In this regard, Filecoin is not alone – while DePIN networks have now proven very successful at bootstrapping supply, the focus of this sector has also now turned towards demand.

There has been some exciting progress on Filecoin’s demand story:

- Growth in the underlying demand for Filecoin’s services

- We are seeing data clients in both Web2 and Web3 paying for storage on Filecoin. In some cases, Filecoin has been chosen in parallel or over Web2 providers.

- The storage provider landscape is reflective of this – whilst capacity and # of SPs have dropped, there has been an increase in quality and data utilization on the network – showing a shift in network resources towards demand

- There is a pathway to scale

- Filecoin is still expanding its core services to cater to demand with important protocol level upgrades – F3, PDP, and Filecoin Web Services (FWS)

- New Filecoin-powered storage solutions have come to market (Akave, Storacha, Recall etc) – and all already charging for deals within their target markets

- DeFi continues to scale on FVM – notably, FIL-backed stablecoins coming online

- Storing more data on the network and creating multi-service APIs creates the building blocks to bring compute needs to the data

Filecoin is at an inflection point as its services mature to meet the demands of AI, enterprise & nation state focus on data locality, and global cost-cutting driving orgs away from costly Web2 cloud providers.

This blog post examines Filecoin’s adoption, including milestones and use cases, its scaling path via infrastructure, tooling, and coordination, and cryptoeconomics, covering incentives, token dynamics, and network sustainability.

Adoption & Client Demand

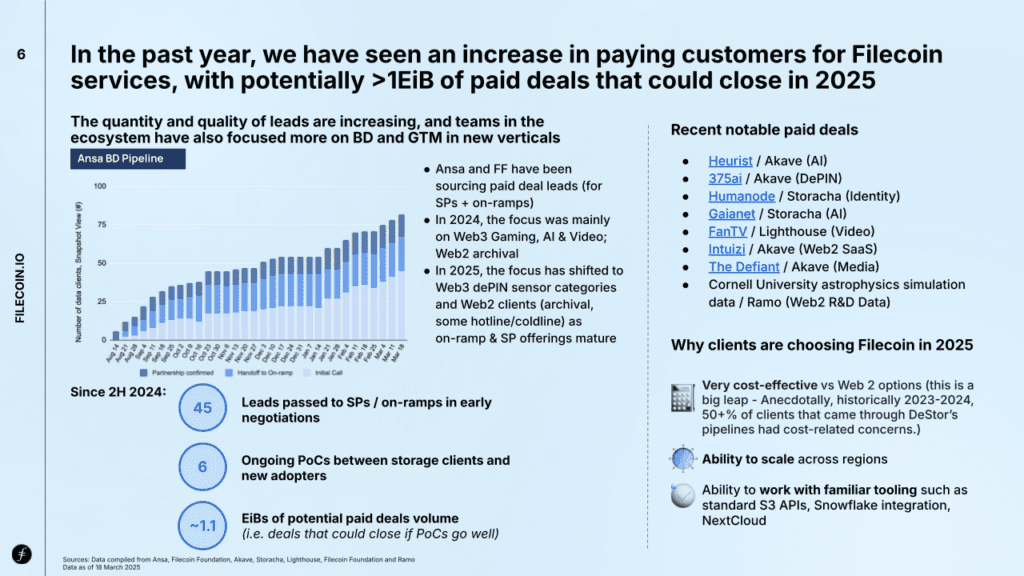

Over the past year, Filecoin has seen a rise in paying customers, with projections suggesting over 1 EiB of paid storage deals could close in 2025. This would raise the network’s utilization from its current 29% to nearly 100% with fully paid usage.

The number and quality of leads are growing, driven by efforts from teams like Ansa Research and the Filecoin Foundation, who are actively sourcing paid deals for on-ramps and Storage Providers. Business development has also shifted focus toward high-potential DePIN categories, particularly those collecting large volumes of consumer data as well as Web2 clients with archival and hot/cold storage needs.

Recent notable paid deals include:

- Heurist / Akave (AI)

- 375ai / Akave (DePIN)

- Humanode / Storacha (Identity)

- Gaianet / Storacha (AI)

- FanTV / Lighthouse (Video)

- Intuizi / Akave (Web2 SaaS)

- The Defiant / Akave (Media)

- Cornell University astrophysics simulation data / Ramo (Web2 R&D Data)

Utilization and Go-to-Market Momentum

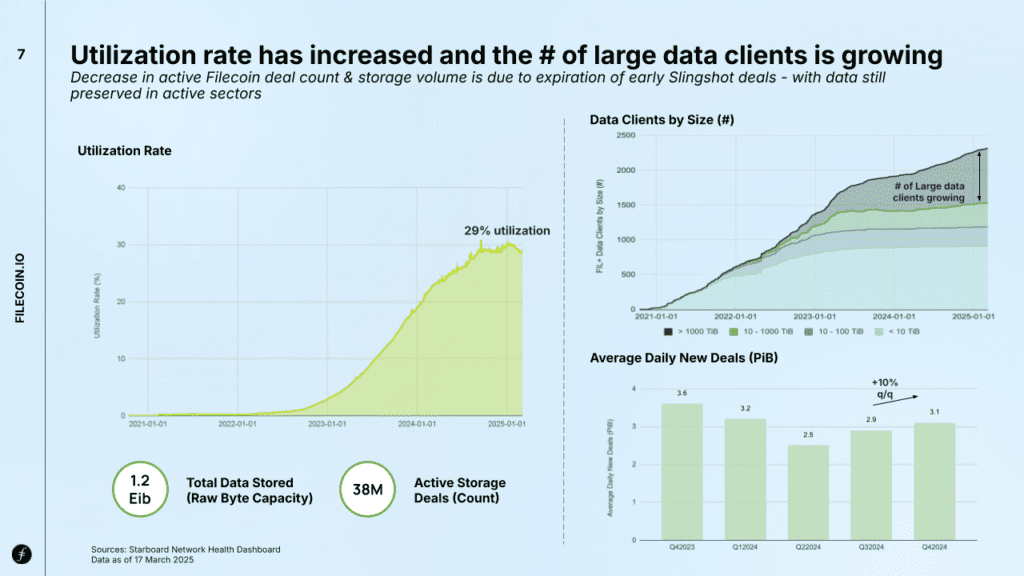

Filecoin’s network utilization has risen to around 29%, signaling increased demand. A growing number of large-scale clients (storing over 1,000 TiB) possibly in the enterprise and/or long-term archival space, demonstrates that efforts by on-ramps and Storage Providers (SPs) are on the right path.

After earlier declines as the network shifted its focus from generating supply to generating demand, average daily new deals have recently increased by over 10% from Q3’24 to Q4’24.

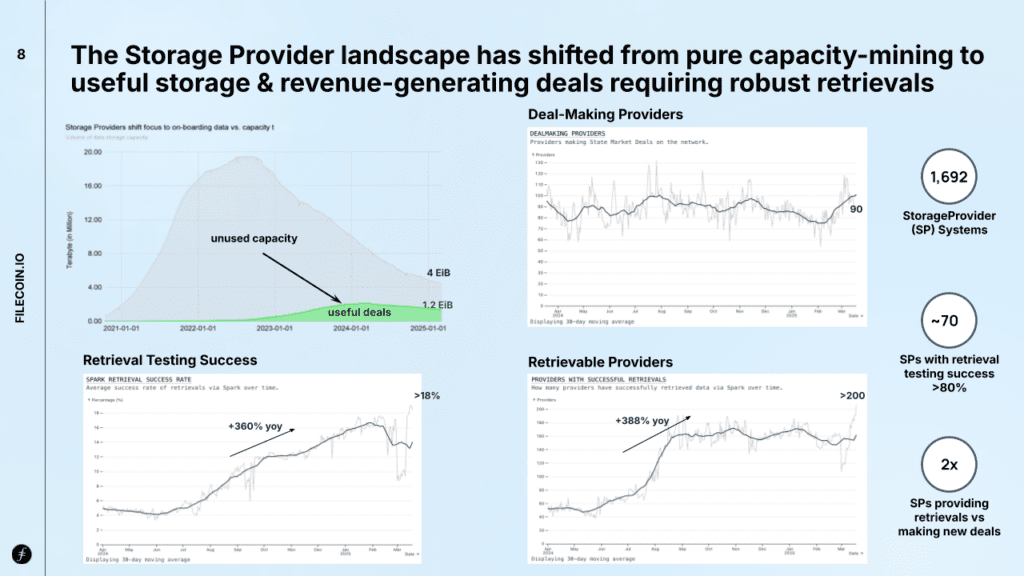

Storage Providers Evolving Beyond Capacity

The Storage Provider (SP) landscape is shifting from a focus on raw capacity to delivering useful, client-driven storage. In its early phase, the network prioritized onboarding as much storage as possible, often without regard for actual usage or retrievability. Now, as Filecoin emphasizes demand generation and adoption, SPs are adapting by pursuing paid deals and ensuring robust data retrieval. This marks a clear move from quantity to quality, with incentives increasingly aligned to real-world client needs – reflected in a 388% year-over-year surge in the number of SPs achieving successful retrievals.

Path To Scale

The network’s path to scale is envisioned along three main lines:

- Expanding core protocol capabilities with the introduction of Proof of Data Possession (PDP), Fast Finality (F3), and Filecoin Web Services (FWS)

- Launching new on-ramps and Layer 2 solutions to support vertical-specific adoption

- Improving economic efficiency through decentralized finance (DeFi)

1. Expanding Core Protocol Services

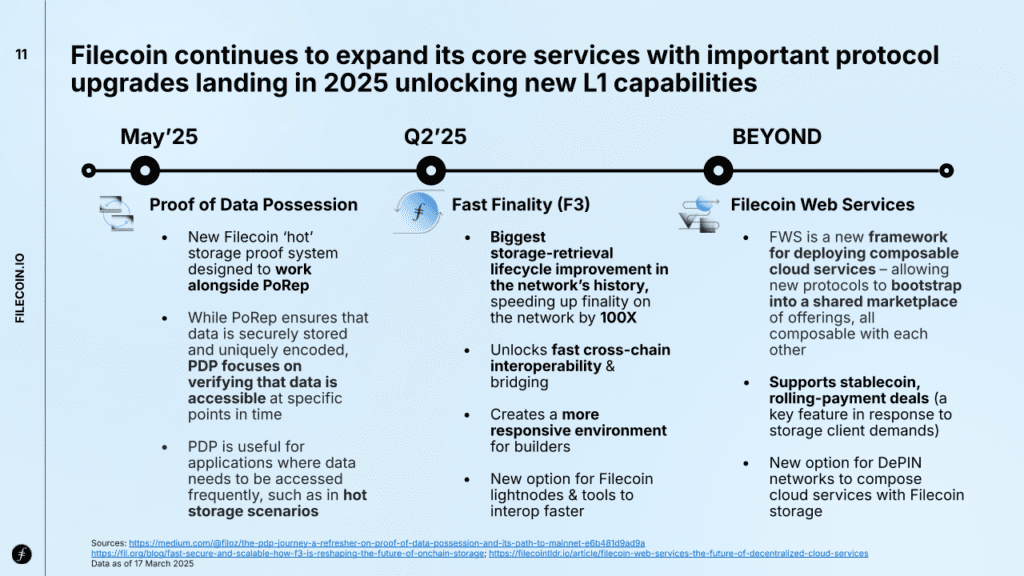

Filecoin will go through key protocol updates, primarily;

- Proof of Data Possession (PDP) – that has shipped as of 8th May 2025, and Storage Providers can participate in PDP SPX, a short-term initiative to onboard select Storage Providers to test, validate, and demonstrate Proof of Data Possession (PDP).

- Fast Finality (F3) – that has arrived early and went live on Filecoin Mainnet as of April 2025, bringing 100x improvement on transaction speeds

- Filecoin Web Services (FWS) – a composable service marketplace for offering multi-service deals

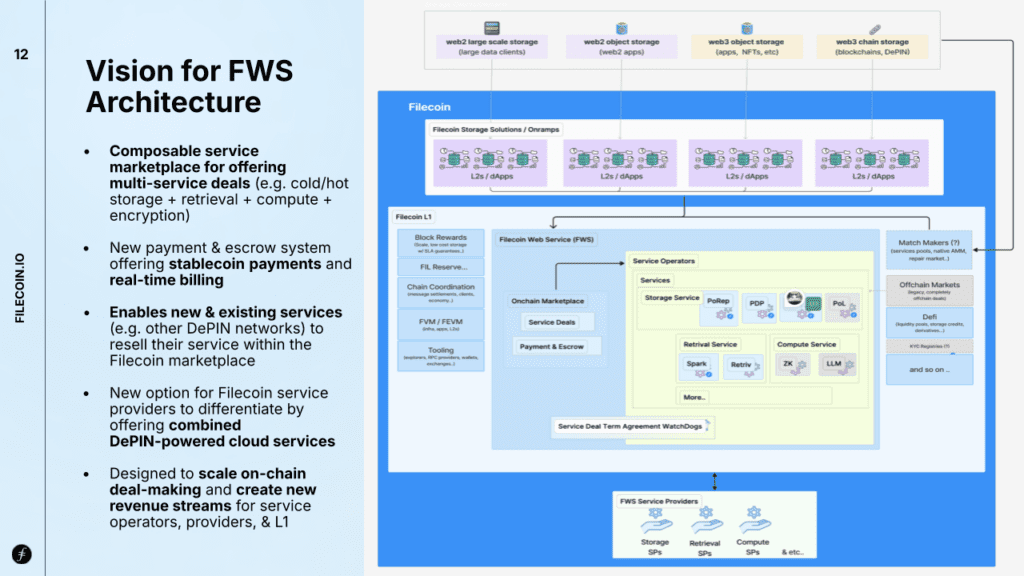

Vision for FWS Architecture

Introduced last year as part of Filecoin’s broader vision, Filecoin Web Services (FWS) marks a major step toward expanding the network’s capabilities beyond storage. At its core, FWS is a composable service marketplace that enables users to bundle multiple services—such as cold and hot storage, retrieval, compute, and encryption—into a single deal.

FWS aims to offer a more flexible and integrated alternative to traditional Web2 cloud platforms. It also opens the door for other DePIN networks to offer and resell their services within the Filecoin ecosystem. With integrated payments and escrow, FWS supports the creation of customizable service combinations, enhancing utility for both consumers and enterprises.

2. New On-Ramps and L2s

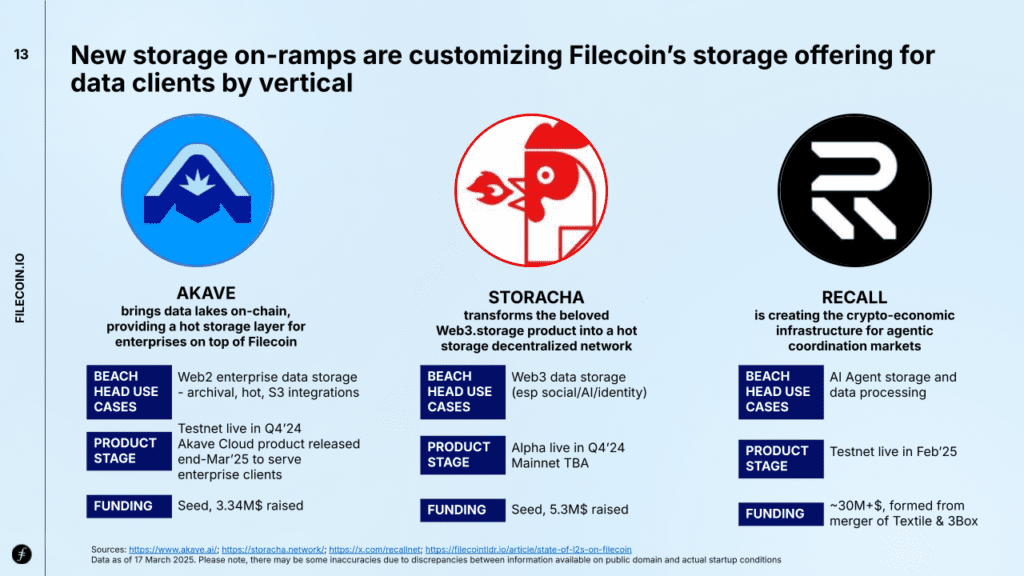

A key part of Filecoin’s scaling strategy is the emergence of new storage on-ramps, functioning like Layer 2s – that are launching mainnets and targeting specific verticals. These startups tailor Filecoin’s storage stack to meet the needs of niche markets, helping to establish beachhead use cases. Notable examples include:

- Akave: Focused on Web2 enterprises, Akave offers a hot storage layer on top of Filecoin, supporting archival, hot/cold storage, and S3 integrations. They’ve also integrated with Snowflake.

- Storacha: Targeting Web3 applications in social, AI, and identity, they specialize in storage solutions for decentralized platforms.

- Recall: Aimed at the AI sector, specifically towards AI agent storage and data processing.

3. Scaling DeFi

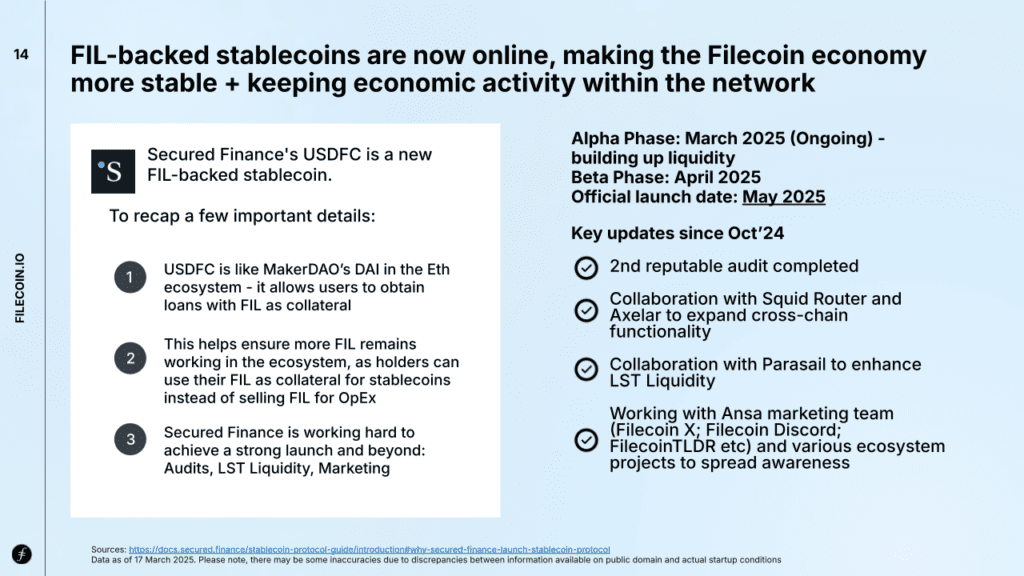

Filecoin’s DeFi ecosystem is growing, playing a key role in improving economic efficiency across the network. A major focus is on stablecoins, which help retain economic activity within the ecosystem. Secured Finance has introduced USDFC, a FIL-backed stablecoin that allows FIL holders and Storage Providers to use their tokens as collateral instead of selling them—similar to MakerDAO on Ethereum.

USDFC is now live, as recently announced at FDS-6 in Toronto.

Cryptoecon Update

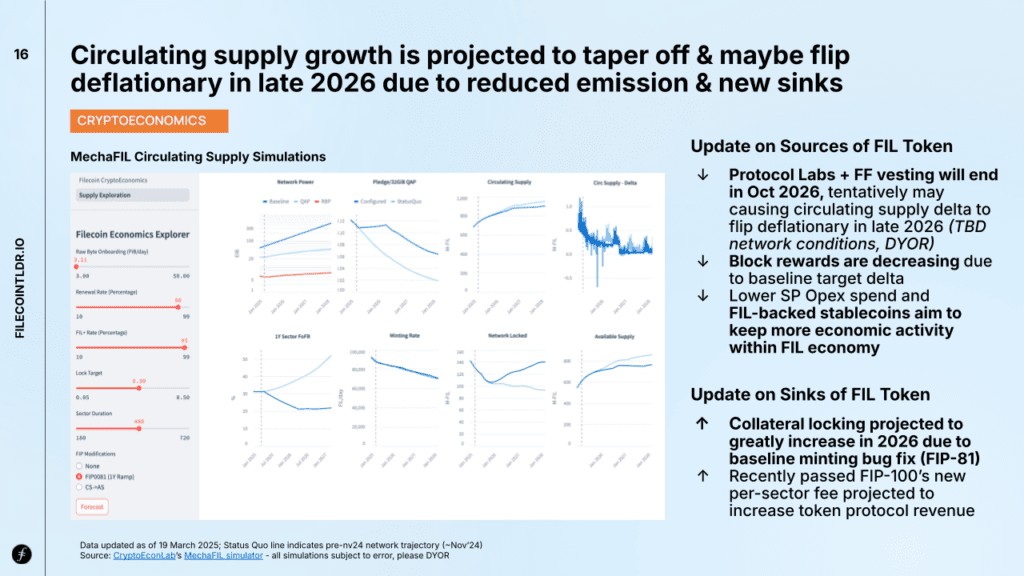

The central forecast: FIL’s circulating supply growth is expected to slow and may turn negative or deflationary by late 2026. This shift stems from a combination of reduced token issuance and increased demand sinks that lock or remove FIL from circulation.

Supply-Side Pressures Easing

Several key developments are reducing new FIL issuance:

- Vesting Completion: Token vesting from early stakeholders, including Protocol Labs and the Filecoin Foundation, ends in October 2026 – removing a major source of new tokens.

- Decreasing Block Rewards: FIL block rewards follow a declining emission schedule by design.

- FIL-Backed Stablecoins: Stablecoins like USDFC by Secured Finance allow FIL holders to use tokens as collateral instead of selling, keeping more value within the network and reducing sell pressure.

Demand-Side Sinks Growing

At the same time, FIL demand is increasing through new utility and locking mechanisms:

- Rising Collateral Requirements: Storage Provider collateral is set to increase in 2025, partly due to a fix under FIP-81 that enhances locking behavior.

- Increased Protocol Revenue: FIP-100 is projected to boost FIL-denominated revenue, much of which is burned or otherwise removed from circulation.

Together, these trends suggest a pivotal moment in Filecoin’s economic evolution: a potential transition to a deflationary supply model, signaling a tighter and potentially more valuable FIL economy.

[Disclaimer: Circulating supply analysis is based on a 3rd party model: https://mechafil-jax-web-levers.streamlit.app/

These models are based on many assumptions, and should not be relied upon as the source of truth. There are many factors that can and will affect the actual numbers. Simulations should not be relied upon and are for illustrative purposes only. DYOR and adjust the model yourself, or build your own models in Dune.]

Filecoin Data (where to get them to DYOR)

For those looking to dive deeper into the Filecoin ecosystem, Ansa Research has compiled a curated directory of key metrics and data sources. These resources provide essential insights into network health, development trends, and adoption signals – making them useful for both regular monitoring and deeper research.

Whether you’re tracking protocol upgrades, storage deals, or adoption patterns, this data directory is a valuable starting point for your own analysis.

👉 Access the Filecoin Data Directory here

In Conclusion

Filecoin is entering a new phase centered on demand, adoption, and long-term sustainability. With supply successfully bootstrapped, focus has shifted to real usage – evidenced by rising paid storage deals, potentially exceeding 1 exabyte by 2025, and a shift toward higher-quality, retrievable data.

Key upgrades like Proof of Data Possession (PDP), faster finality (F3), and new Layer 2 solutions are unlocking capabilities across data and DeFi, including FIL-backed stablecoins that help retain value within the network.

At the same time, token issuance is set to slow, with vesting ending in late 2026 and block rewards declining – while demand sinks like collateral locking (FIP-81) and protocol revenue (FIP-100) increase. Together, these trends suggest a potential shift to a deflationary FIL supply and a more mature, sustainable network economy.

To listen to the entire talk by HQ Han (Ansa Research) at FDS-6, watch here on YouTube:

Disclaimer: This information is for informational purposes only and is not intended to constitute investment, financial, legal, or other advice. This information is not an endorsement, offer, or recommendation to use any particular service, product, or application.