Editor’s Note: This blogpost is a summarised repost of the original content published on 25 April 2025, by Jonathan Victor from Ansa Research. Ansa Research is a research firm focused on distributed infrastructure. The firm covers digital networks aiming to rebuild how internet infrastructure operates.

Introduction

In the evolving landscape of blockchain technology, understanding how a network accrues and sustains its value is paramount for its long-term success. This fundamental question of value accrual is critically examined for Filecoin, drawing comparisons to established models like Bitcoin and other Layer 1 (L1) blockchains such as Ethereum and Solana.

While many Layer 1 networks accrue value through internal services or consensus mechanisms, Filecoin’s path stands apart. Filecoin’s long-term value proposition hinges on external demand – particularly the sale of decentralized storage and Filecoin-backed services.

This ecosystem-wide strategy raises two critical questions:

- How can external service adoption be meaningfully tied to the network’s long-term value?

- How can this model integrate with the rise of Layer 2s in a way that strengthens the broader Filecoin economy?

The path forward depends on cultivating sustainable, non-speculative value flows. This blogpost explores the core challenges in aligning external demand, protocol design, and Layer 2 development to unlock Filecoin’s full potential.

Understanding Value Accrual Models

To contextualize value accrual mechanisms, let’s start with Bitcoin’s model.

Bitcoin’s Value Accrual Model:

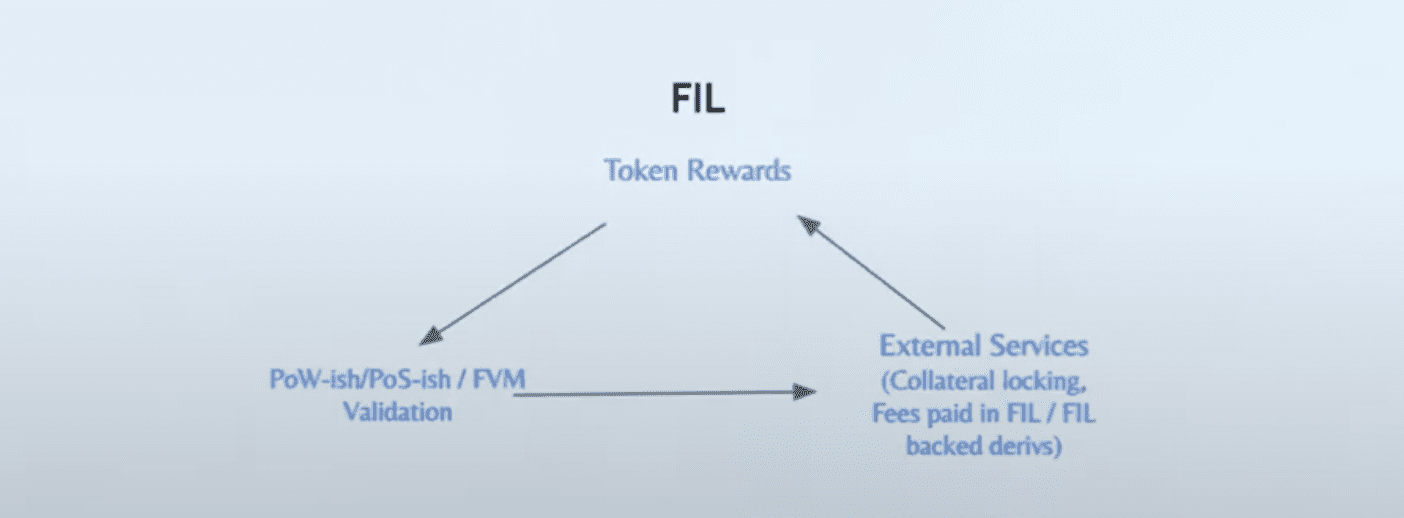

Bitcoin’s value accrual loop is fundamentally tied to its proof-of-work (PoW) security. This security mechanism underpins a compelling narrative, positioning Bitcoin as a decentralized store of value that is backed by energy.

This narrative is crucial because it gives value to the token rewards. These token rewards, in turn, serve to incentivize the proof-of-work process itself. This creates a self-reinforcing cycle or “nice little loop” where the security of the network reinforces the value of its token, and the value of the token incentivizes the maintenance of that security. The ecosystem has a strong tie around this narrative value, emphasizing concepts like the fixed supply of 21 million Bitcoins backed by energy and proof-of-work.

Ethereum and Solana: Value Through Utility

Unlike Bitcoin’s narrative-driven model, Ethereum and Solana accrue value through direct network usage. Their Proof-of-Stake (PoS) systems underpin a utility-centric loop: users pay in native tokens (ETH, SOL) to access core network services, creating real demand.

Key drivers of this value loop include:

- Blockspace sales – users pay to include transactions

- Execution fees – costs to run smart contracts

- Storage fees – charges for persisting data

- Transaction prioritization – optional fees to expedite processing

This model links token value to actual on-chain activity. The more developers build and users interact, the more these L1 tokens accrue value – not from external narratives, but from tangible utility baked into the protocol itself.

Filecoin’s Chosen Path: External Services

While networks like Bitcoin, Ethereum, and Solana accrue value through native mechanisms – whether through security incentives or on-chain usage, Filecoin’s approach centers on external demand.

Filecoin’s proposed path for long-term value accrual lies in external services. This strategy involves actively selling Filecoin storage or Filecoin-backed services to the broader world..

This strategic direction raises fundamental questions regarding its execution:

- How to effectively connect the sale of these external services to the actual Filecoin value accrual story

- How this strategy will function within the growing landscape of Layer 2s (L2s), particularly ensuring that the growth of L2s (especially if they become a significant source of demand generation) is symbiotic and aligned with the Filecoin network

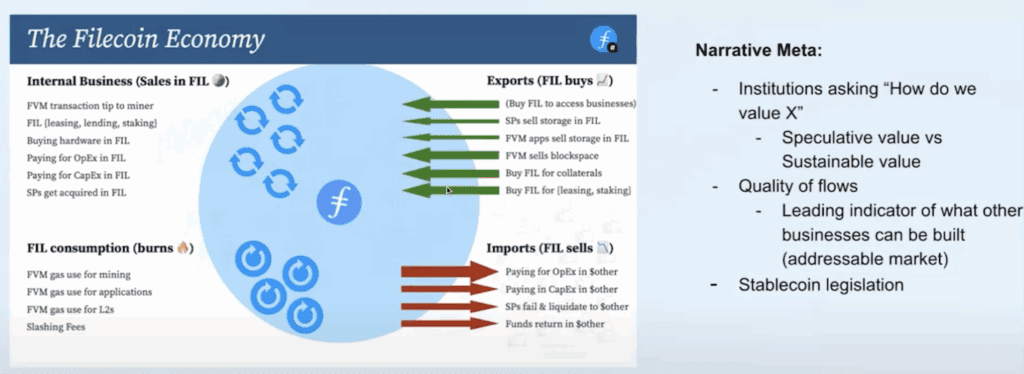

Visualizing Value Flow in the Filecoin Economy

Understanding how value flows throughout the Filecoin economy is crucial for its value accrual. Value flows into the Filecoin economy when people buy FIL to utilize services that Filecoin pushes out into the world. The more that internal transactions can be generated, and mechanisms for locking FIL are created, the more internal demand can be fostered within the ecosystem.

Additionally, consumptive elements, such as gas fees, permanently remove Filecoin from circulation. Conversely, “imports” occur when Filecoin is used to fund external operational or capital expenses.

The goal is to increase the balance of trade so that FIL is more directly connected to the actual value capture loop, rather than merely existing passively on the side. This means ensuring that revenue generated through external services ultimately accretes into the broader Filecoin story and can be measured on-chain.

Filecoin’s Strengths, Challenges, and Opportunities

Filecoin holds a distinct position in the crypto landscape – especially in the DePIN (Decentralized Physical Infrastructure Networks) category. Understanding its current standing requires looking at its core strengths, the hurdles it faces, and where the biggest opportunities lie as it pushes toward sustainable value accrual.

What Sets Filecoin Apart

Filecoin brings a combination of physical infrastructure and economic design that differentiates it from other Layer 1s:

- Hardware-Heavy Network: Unique especially among DePINs due to the total aggregate value of the capital it holds, with its deployed hardware serving as the economic base for productive monetization.

- Established Brand & Distribution: Broad awareness and institutional credibility position Filecoin well for onboarding partners and developers.

- Early Focus on Real Revenue: The ecosystem leads most crypto networks in thinking about sustainable monetization and generating cash flows into the Filecoin economy.

Key Challenges on the Road to Value Accrual

Despite these advantages, Filecoin faces several challenges as it aims to solidify its value loop and drive demand for FIL:

- Infrastructure Gaps

- Latency-sensitive use cases remain challenged by Filecoin’s block times and finality constraints

- On-chain payments can feel clunky for end users, particularly when compared to the smoother experiences on more payment-oriented chains

- Ecosystem Positioning and Alignment

- As Layer 2s emerge, ensuring alignment with FIL’s value accrual model is crucial. Fragmented tokens and narratives could dilute FIL’s role if not carefully managed

- Some new DePIN projects default to other L1s like Solana – Filecoin must remain proactive in competing for developer and user mindshare

- Strengthening On-Chain Value Capture

- Converting real-world demand (e.g., storage usage) into on-chain value remains a work-in-progress. FIL-based settlement is not yet the default for many clients, especially those operating in fiat or off-chain contexts.

- DeFi and dynamic applications still face adoption friction, with FIL-denominated flows requiring better incentives and infrastructure.

- Clarity and Proof of Progress

- The ecosystem is in a “show me” phase – with more focus on proving real usage, rather than relying solely on forward-looking narratives

- Complexity around tokenomics (e.g., Baseline vs. simple minting) remains a source of confusion, though this is likely to ease post-2026

Opportunities That Could Drive the Next Growth Cycle

If executed well, these strategic opportunities could solidify Filecoin’s role as a foundational layer for decentralized infrastructure:

- Strengthen FIL-Centric Economics

- Anchor core services (storage, compute, sealing-as-a-service) into measurable on-chain FIL flows

- Offer tangible benefits (e.g., fee discounts, better credit terms) to incentivize native FIL payments

- Identify where value leaks from the ecosystem and redesign those flows to keep more within the Filecoin economy

- Activate the Storage Provider Base

- Help SPs monetize their deployed capacity through tools like Ramo and aligned L2s that translate hardware into cash flow.

- Scale Through Layered Ecosystem Plays

- Build derivative businesses, from compute networks to data marketplaces – atop established usage patterns.

- As flywheel momentum builds, Filecoin can move into adjacent sectors like AI data infra, persistent rails, and verifiable compute.

- Ensure Ecosystem Alignment

- Define what “aligned L2s” look like and structure token incentives to reward symbiotic behavior.

- Encourage system coherence to ensure long-term value accrual flows back to FIL

The Three-Step Pitch for Maximizing Value

To reach its full potential, Filecoin must go beyond narratives and demonstrate measurable, on-chain economic activity. The goal is to establish a value loop that drives real revenue, aligns with tokenomics, and reinforces the network’s long-term utility.

1. Anchor Non-Speculative Value On-Chain

- The primary goal is to settle meaningful, revenue-generating activity on-chain to counter inflation and establish durable demand for FIL.

- What counts as non-speculative value:

- Monetizing hardware (e.g., storage providers earning from sealing, compute jobs, etc.)

- Services like “sealing-as-a-service” and running compute jobs on unused storage

- Tools like CIDGravity, Storacha, Akave, Lighthouse, Curio, and Ramo make it easier for storage providers to convert hardware capacity into fiat-based revenue streams

- On-chain settlement matters:

- Enables visibility and measurement

- Avoids fragmentation across L2s/subnets where value might accrue to other tokens instead of FIL, letting FIL remain as the “default currency” of value

2. Develop Derivative Businesses

- Once core economic activity is on-chain, the next step is to build businesses that leverage this foundation.

- These could include analytics, marketplaces, compute services, or data tooling tied to Filecoin’s storage layer

- This helps translate ecosystem growth into value that extends beyond storage alone

3. Expand the Total Addressable Market (TAM)

- With the value flywheel spinning, Filecoin can broaden its scope:

- Serve more use cases (e.g., AI, big data, verifiable compute)

- Attract new market segments beyond Web3

- Strengthen its position as the default infrastructure for decentralized data

Conclusion

Filecoin’s challenge and opportunity lie in building a credible value accrual loop—anchored in real-world utility, on-chain revenue, and aligned ecosystem growth. Moving beyond narrative, its long-term success depends on turning external demand into sustained economic gravity.

To learn more about Filecoin Value Accrual, explore the following talk that happened during FDS-6:

- Filecoin value accrual: now and in the future (by Jonathan Victor, Ansa Research)

Disclaimer: This information is for informational purposes only and is not intended to constitute investment, financial, legal, or other advice. This information is not an endorsement, offer, or recommendation to use any particular service, product, or application.