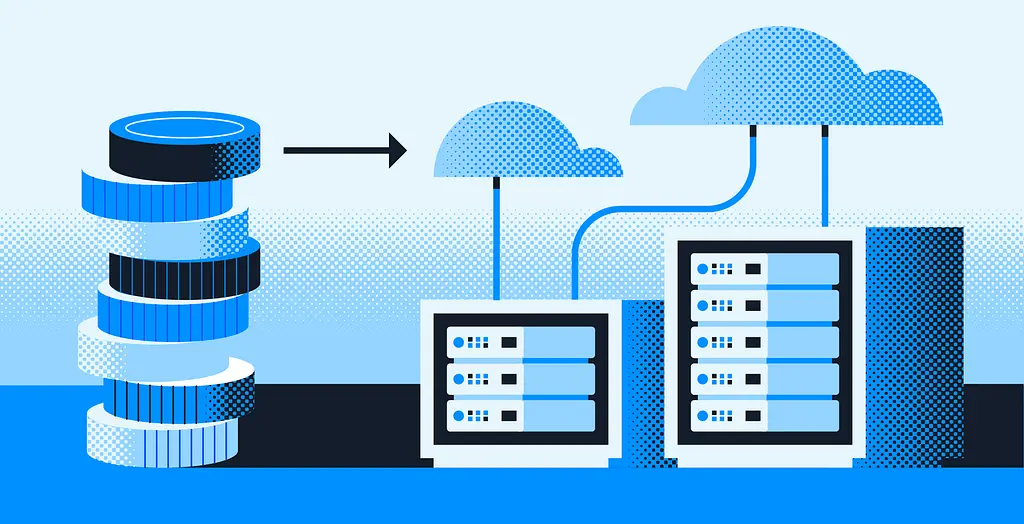

Filecoin’s larger roadmap aims to turn cloud services into permissionless markets on which any provider can offer their services. The network started with Storage markets, with the Mainnet launch in October 2022. More recently, the Filecoin Virtual Machine (FVM) was introduced to bring smart contract functionality onto the network. This allows for user programmability around key services on the Filecoin network: which includes Large-scale Storage, and soon, Retrievals.

In this post, we dive into the Retrieval markets that Filecoin is developing and one of its lighthouse projects. We will cover the following topics:

- Filecoin’s Retrieval Markets and the Retrieval Markets Working Group (RMWG)

- Content Delivery Networks (CDNs) and the role of Project Saturn

- Saturn’s approach to a decentralized CDN and its traction to date

- What’s next for Saturn

Filecoin’s Retrieval Markets and the RMWG

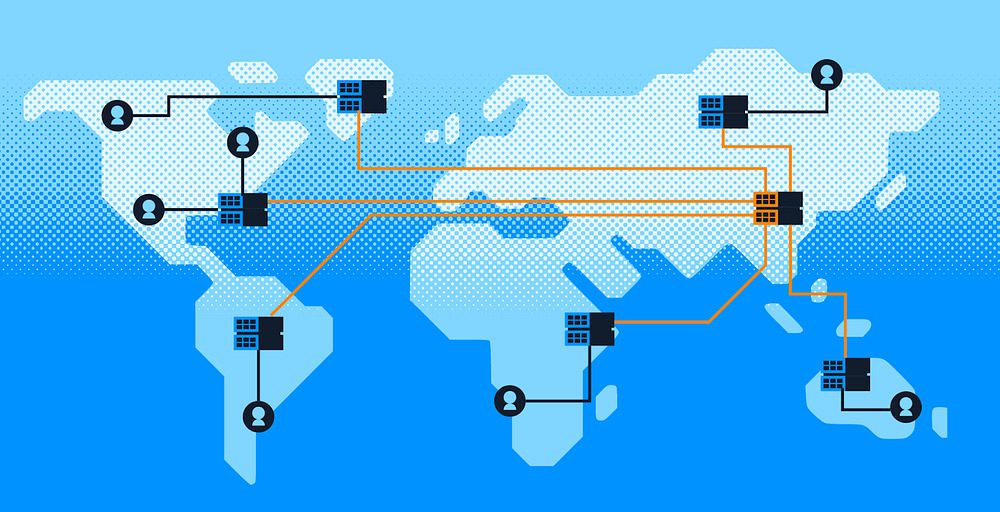

As covered earlier in our previous post, Filecoin seeks to build open services for data, which consists of three main pillars (Storage, Retrieval, and Compute-over-Data). Storage has been a key emphasis for Filecoin from 2020 to 2022 — it has emerged as the largest decentralized storage network to date, with over 1,170 PiB of data stored, and 200,000+ users ranging from Opensea to the Internet Archive. The remaining pillars of Retrieval and Compute-over-Data have been in development since 2022, with working groups (open for any individual or entity to join) organized around building these markets. The working groups encourage modularity and often consist of different teams that tackle different pieces of the puzzle.

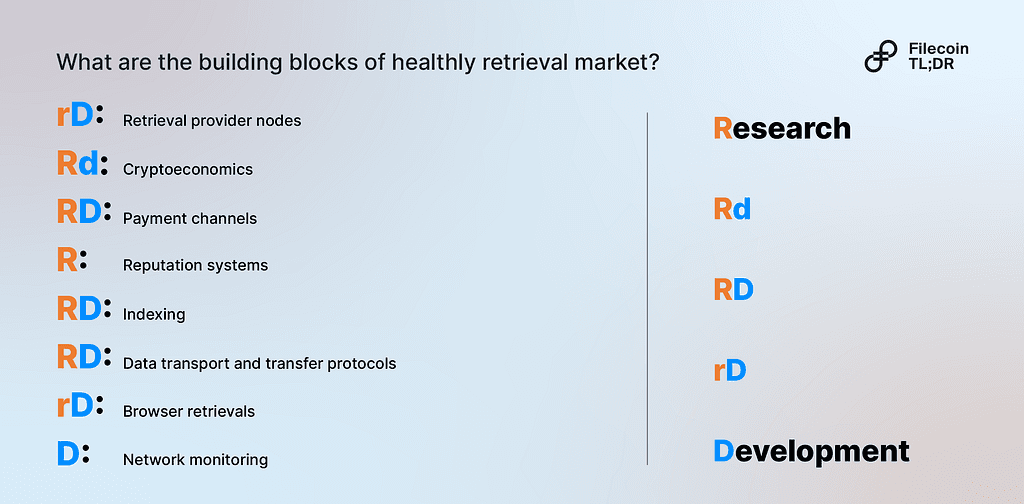

The Retrieval Market Working Group (RMWG) is centered around building a decentralized CDN (Content Delivery Network) for the Filecoin ecosystem. Over 15 teams (such as Magmo, Ken Labs, Protocol Labs, and more) are contributing to tackling technical challenges in the space, from enabling ultra-fast payments to data transfer protocol enhancements to crypto-economic models for data retrieval. The following are building blocks the RMWG has been organizing itself around since H1 2022 and is built off an envisioned retrieval flow that can interact freely with Filecoin’s storage markets.

Even in its R&D stage, projects in the RMWG are already serving 160 million daily retrieval requests and more than 2 PB of data per month. Collectively, these projects will seek to enable a decentralized CDN that can serve not just the web3 space, but the web2 market as well.

CDNs and the role of Project Saturn

Content delivery networks are a key part of the Internet’s infrastructure. Groups of servers work together to provide fast delivery of internet content, from static web pages to YouTube videos. Incumbent CDN providers include players such as Cloudflare, Akamai, and Fastfly. Businesses pay for these services instead of the end-user, which means that service consistency, coverage, and pricing are critical.

The CDN market today is highly centralized and dominated by a few big players. Only 7 CDN providers serve over 80% of market needs. This brings about sizable concentration risk in the event of network failures (e.g. CloudFlare outage in 2022), and higher latencies in regions far remote from the closest data centers (e.g. Africa).

A distributed model of smaller CDNs in various regions could effectively solve these problems, but economies of scale have prevented smaller, distributed CDNs from challenging incumbent providers (capital outlay could reach up to billions per year). Delivering web content better than incumbent providers will open up a significant commercial opportunity. The global CDN market size accounts for US 20Bn in 2022 and is expected to reach around 100Bn by 2032 (not counting new web3-based use cases such as NFTs). This is where Project Saturn comes in.

A web3 CDN can potentially overcome this challenge by allowing anyone to contribute resources for content retrieval (provided they fulfill minimum criteria) in a network. This shifts the burden from a single company to thousands (or more) of companies supporting the network, reducing barriers to entry. This is where Project Saturn comes in. Project Saturn is a decentralized CDN network built on Filecoin, that seeks to enable reliable, performant, and economic retrieval of content on the Internet. It is one of the key projects in the RMWG, with a public launch in November 2022. Saturn seeks to achieve the following:

- Democratize the CDN market, by allowing anyone to serve as a Saturn node operator in return for crypto-incentives. Nodes can join in a permissionless manner, allowing for multiple companies or individuals to contribute towards a retrieval network (think franchising), which leads to a wider and more distributed footprint

- Performant retrievals, with under 100ms TTFB, high network bandwidth, and low latency across all geographies, owing to a high density of nodes being distributed across each continent. While this does not exist today, it can potentially be achieved given a wider geographic distribution of nodes

- No single point of failure unlike traditional CDN networks

- Data integrity and authenticity by leveraging content-addressability. Project Saturn is the only decentralized CDN that is natively compatible with content-addressing

Saturn approach and traction to date (Aug 2023)

The data below is accurate as of August 2023, unless otherwise stated. Data for number of Active Nodes are accurate as of November 2023, owing to a upgrade in October 2023 that removed multi-noding behavior in the network, while keeping TTFB performance stable.

While Saturn’s ambition is to serve as a credible alternative to traditional CDN networks, its near-term goal is to effectively fulfill the billions of requests received each week for content-addressed data on Filecoin and IPFS. This is currently being fulfilled by IPFS Gateway, which serves as a key benchmark for Saturn as it improves its network capacity and performance.

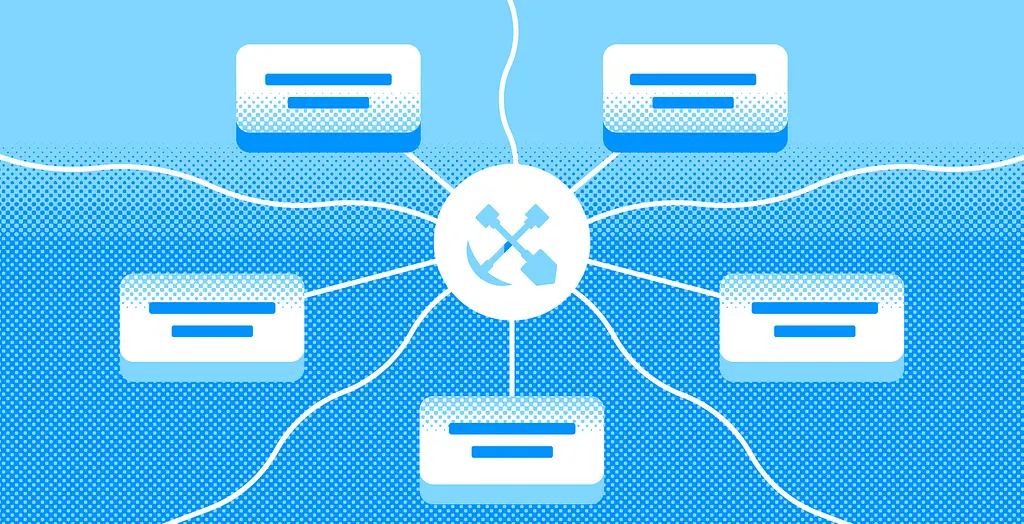

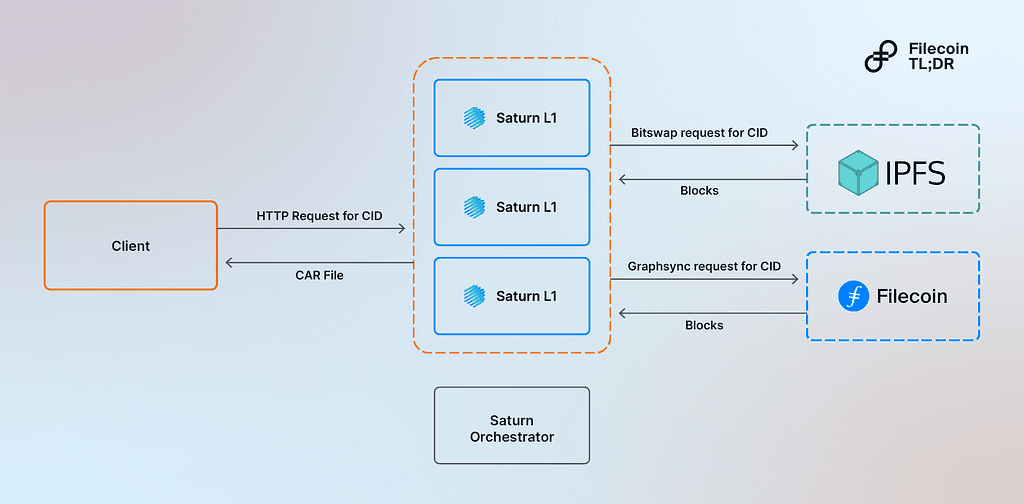

Saturn’s approach involves four main network actors in enabling retrievals from Filecoin and IPFS:

- Node operators offer their hardware and resources to the Saturn network by running Saturn nodes in different geo-locations around the world. They are rewarded based on how many bytes they serve to clients over each payment epoch. Saturn nodes join the network by registering with the Saturn Orchestrator. The network of Saturn L1s provides a huge geographically distributed cache of content-addressed data for Saturn clients

- Saturn Orchestrator manages the membership of node operators in the Saturn Network and facilitates the payment process to these nodes. This is a key function in democratizing data retrievals while ensuring that qualified participants enter the market. Over time, the aim is for the orchestrator to run entirely on theFilecoin Virtual Machine (FVM)

- Clients: Network users make requests for content from the Saturn network. The Client is the device used to make the request. Clients make HTTP requests to the Saturn network and get back CAR files, allowing clients to verify the file incrementally. When a Saturn L1 doesn’t have a file in its cache, it “cache-misses” to wherever the file is stored in either the IPFS Network or the Filecoin network, and returns it to the client

- Customers use the Saturn Network as a CDN to accelerate their content to their users. Saturn customers can accelerate their content to a large number of Saturn nodes around the world to create a performant experience for end users

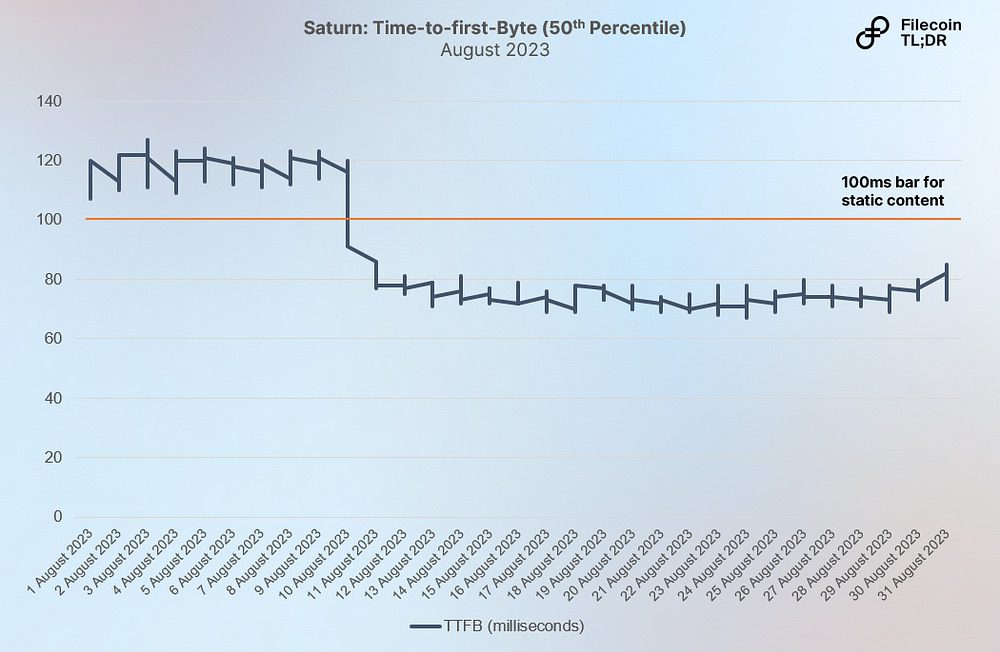

Significant developments have been made on Project Saturn to date. Following its public launch in November 2022, Saturn now has 80ms Time-to-first-byte (TTFB) at the 50th percentile, serves 30% of mirrored traffic from IPFS.io via the Bifrost Gateway, and has launched a verifiable node reward payout system on FVM.

It also has made significant headway in developing a network that is geographically diverse, capable of handling high-volume requests, and able to deliver content in a performant manner (low time-to-first byte). Since its public launch (just 8 months), Saturn has achieved:

- Over 2,000 global points of presence (across 59 countries)

- Capacity to serve 478 Million requests each day (in July 2023)

- 80 milliseconds time-to-first-byte (TTFB) for IPFS content

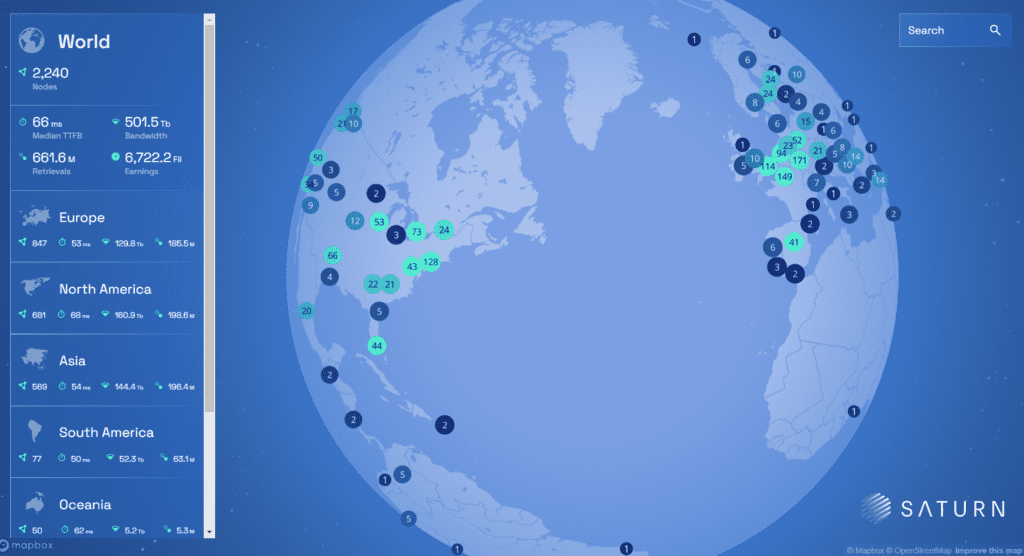

1) Over 2,200 retrieval providers worldwide (comparably distributed to traditional CDN providers)

Over 2,200 retrieval providers are currently on Saturn contributing to network bandwidth. This is a strong 11.8% MoM (month-on-month) growth, starting with only 662 nodes at the end of 2022. As a point of comparison, Filecoin’s storage markets grew by 21% MoM in its first 6 months, with approximately 3,500 storage providers on the network today (the largest in the web3 storage space)

This is comparably distributed to traditional CDN providers today. Akamai, the largest CDN globally, with a 35% market share, also has over 4,000 points of presence globally, while the next closest player (Alibaba) has only an estimated 2,800 points of presence (with the majority in China).

This speed of growth attests to the accessibility of serving as a retrieval provider on the Saturn network. It takes only 4 terabytes (TB) of storage and Saturn’s open-source software to run a Saturn CDN node (considerably less resource-intensive than being a storage provider on Filecoin). Saturn will allow more individuals to participate in Filecoin’s decentralized markets for data services.

Participation across geographies remains diverse: with the most nodes in Europe (800+), followed by North America (600+), and Asia (500+). Median TTFB remains consistently low across all continents, with Europe, Asia, Oceania, and South America experiencing sub-100 ms TTFB.

Distribution of these nodes is important, as it allows for the lowest possible distance between clients and nodes, translating to low latency for end-users (overcoming the speed of light problem experienced with traditional CDN providers). Saturn’s permissionless and crypto-incentivized attributes allow for a more ‘elastic’ supply to match with fast demand growth in developing regions like Asia and Africa, which are currently experiencing those latency issues today.

2) Saturn served an average of ~10.3 Billion requests monthly across 2023

Saturn has a network capacity of around 25+ terabits per second (approximately 10% of the network capacity of Cloudflare). An average of 10.3 Billion requests are served monthly across 2023, with 3.7 Million Gigabytes of monthly bandwidth served. Over 478 million daily requests were being handled as of the end of July 2023, which is close to 50% of IPFS Gateway’s daily requests in the same time frame. Despite its progress thus far, there remains room for stabilization in Saturn’s network capacity.

3) Time-to-first-Byte is already under 80 milliseconds

Speed is an area where Saturn has shown significant results; the median TTFB (time-to-first-byte) is already under 80 milliseconds. Typically, a good TTFB lies below 100 ms for static content, and 200–500 ms for dynamic content. Saturn today is already the fastest content-addressable CDN globally with 80 ms TTFB and has further headroom for improvement as the network continues to become denser. Aside from Saturn, there also exist parallel developments to drive improved retrieval performance in the Filecoin network. This includes projects such as Rhea, which is seeking to optimize IPFS Gateway performance.

What’s next for Saturn

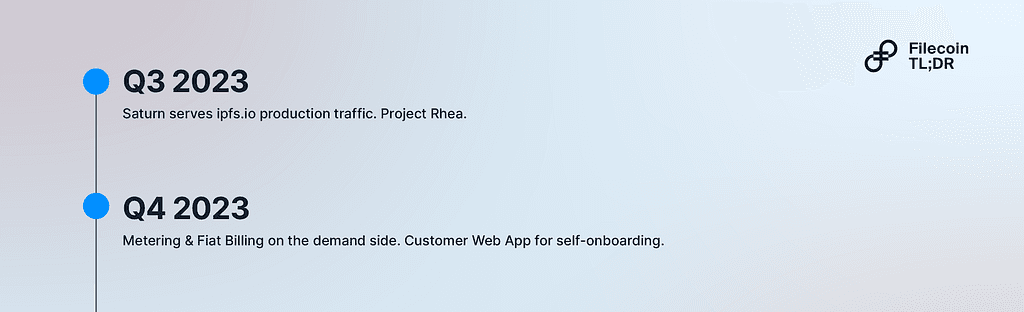

Since its public launch, Saturn has achieved significant progress as an open-source, community-run CDN network. Moving forward, the team looks to continue pushing towards better TTFB speeds, while improving performance correctness and latency. Towards the end of 2023, Saturn looks to achieve further milestones. These include serving 100% of IPFS.io traffic, implementing metering and billing on the customer demand side, and launching a web app to enable customer self-onboarding who want to accelerate content with Saturn.

You can keep up to date with Project Saturn, and other projects within the RMWG here. Data in this post is accurate as of 31st August 2023 unless otherwise stated.

Many thanks to the amazing HQ Han, Jonathan Victor, Alexander Kintsler, and the Project Saturn team for their input in publishing this piece.

🇨🇳Filecoin检索市场发展更新:聚焦Filecoin Saturn

Disclaimer: This information is for informational purposes only and is not intended to constitute investment, financial, legal, or other advice. This information is not an endorsement, offer, or recommendation to use any particular service, product, or application.